06.12.2018 - Comments

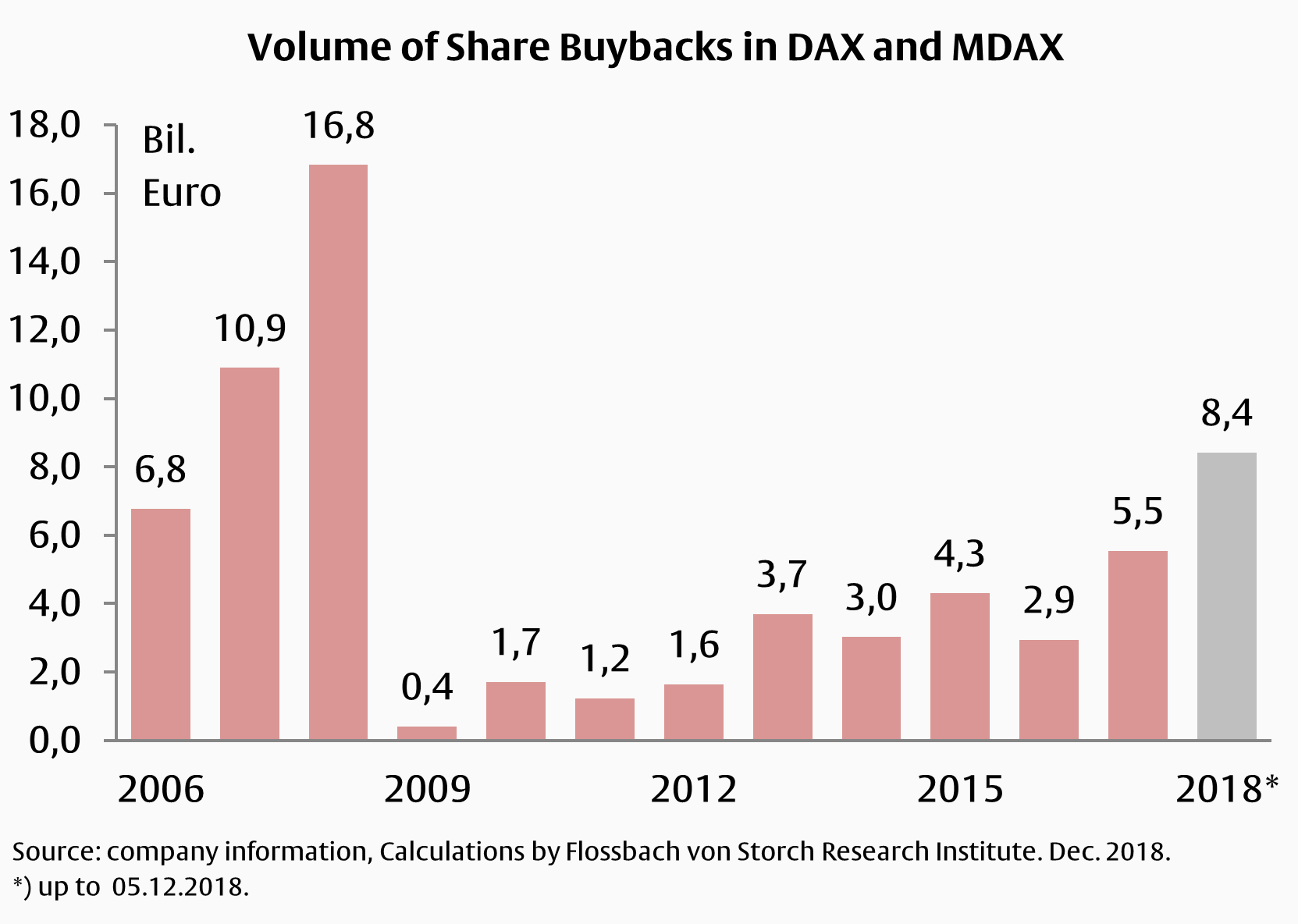

The buyback fever is spreading! At the end of 2018, the volume of share buybacks by DAX and MDAX companies exceeded the eight billion Euro mark and amounted to 8.4 billion Euros at the beginning of December.

Nine companies were active in 2018, above all Allianz, which invested as much as three billion euros in its own shares. Siemens has the second-highest volume with around 1.5 billion euros, followed by Covestro with just under 1.4 billion euros. Adidas has also been extensively active, spending one billion euros on buybacks and announcing a further two billion euros.

The previous year's volume of EUR 5.5 billion seems quite modest compared with the latest figure, although this figure already represents the highest volume since 2009.

Why did the German companies increasingly resort to share buybacks this year? To answer this question, you have to take a closer look at the capital allocation of companies.

A decision for share repurchases is at the same time a decision against investments, against a higher dividend, against the repayment of loans and against increased cash holdings. It is therefore desirable from an investor's point of view if management only decides to repurchase shares once all other options have been exhausted.

The decision to buy back shares is plausible in the case of Adidas. 2018 is a record year for Adidas. Already at the end of the third quarter, profit and operating cash flow were significantly higher than in the prior-year quarter. At the same time, investments were made in the operating business and the balance sheet also makes a solid impression. This enables Adidas to use part of the funds raised during the year directly for share buybacks. In addition, the volume can be flexibly adjusted to operating income. A special dividend would not offer management this flexibility.

However, despite all the joy, one should not forget the pro-cyclical course of share buybacks. Companies can only buy their own shares if they have sufficient excess liquidity. This is usually the case when business is going well. The capital market quickly gets wind of good business and lets the share price rise accordingly. Therefore, the prerequisites for share buybacks are usually only met if the prices are also high. This leaves companies with no choice but to buy their own shares at high prices.

The historical volume of share buybacks in Germany shows that this does not always go well. So far in 2008, the largest volume of share buybacks has been carried out at top prices. A little later, the crisis set in and prices fell. With 8.4 billion euros in 2018, the volume is now only half that of 2008, but for the last 10 years it represents the record value.

For companies and investors, it remains to be hoped that no imminent recession will follow and that the money from the buybacks will not soon be missing elsewhere.

Legal notice

The information contained and opinions expressed in this document reflect the views of the author at the time of publication and are subject to change without prior notice. Forward-looking statements reflect the judgement and future expectations of the author. The opinions and expectations found in this document may differ from estimations found in other documents of Flossbach von Storch AG. The above information is provided for informational purposes only and without any obligation, whether contractual or otherwise. This document does not constitute an offer to sell, purchase or subscribe to securities or other assets. The information and estimates contained herein do not constitute investment advice or any other form of recommendation. All information has been compiled with care. However, no guarantee is given as to the accuracy and completeness of information and no liability is accepted. Past performance is not a reliable indicator of future performance. All authorial rights and other rights, titles and claims (including copyrights, brands, patents, intellectual property rights and other rights) to, for and from all the information in this publication are subject, without restriction, to the applicable provisions and property rights of the registered owners. You do not acquire any rights to the contents. Copyright for contents created and published by Flossbach von Storch AG remains solely with Flossbach von Storch AG. Such content may not be reproduced or used in full or in part without the written approval of Flossbach von Storch AG.

Reprinting or making the content publicly available – in particular by including it in third-party websites – together with reproduction on data storage devices of any kind requires the prior written consent of Flossbach von Storch AG.

© 2024 Flossbach von Storch. All rights reserved.