12.10.2018 - Comments

When Warren Buffett breaks with his principles, the weather on the capital markets must be extraordinary. Normally, the oracle from Omaha rarely makes share buybacks and has strict rules when they are eligible. But recently he announced that he would break his self-imposed rules and make buybacks, even if the conditions were not met.

What is so special about share buybacks?

A company acquires its own shares on the capital market and subsequently cancels them. As a result, there are fewer shares among which the profit is distributed. The pie remains the same size, only the number of pieces into which it is cut is reduced. As a result, the shares must become larger, i.e. the share price must rise.

Sounds good for now. What's the catch?

The problem with share buybacks, as with other distributions, is that money is spent but no new assets are acquired. Demand for shares is increased, or supply is reduced, but no new assets are purchased that could generate future income. The money is permanently gone, but the price nursing measure could be only of short duration.

Therefore, share buybacks should only be a last resort. Before this measure is taken, all investment and acquisition opportunities must be exhausted and the balance sheet must be solid, i.e. the cash register must be sufficiently full and debts largely repaid.

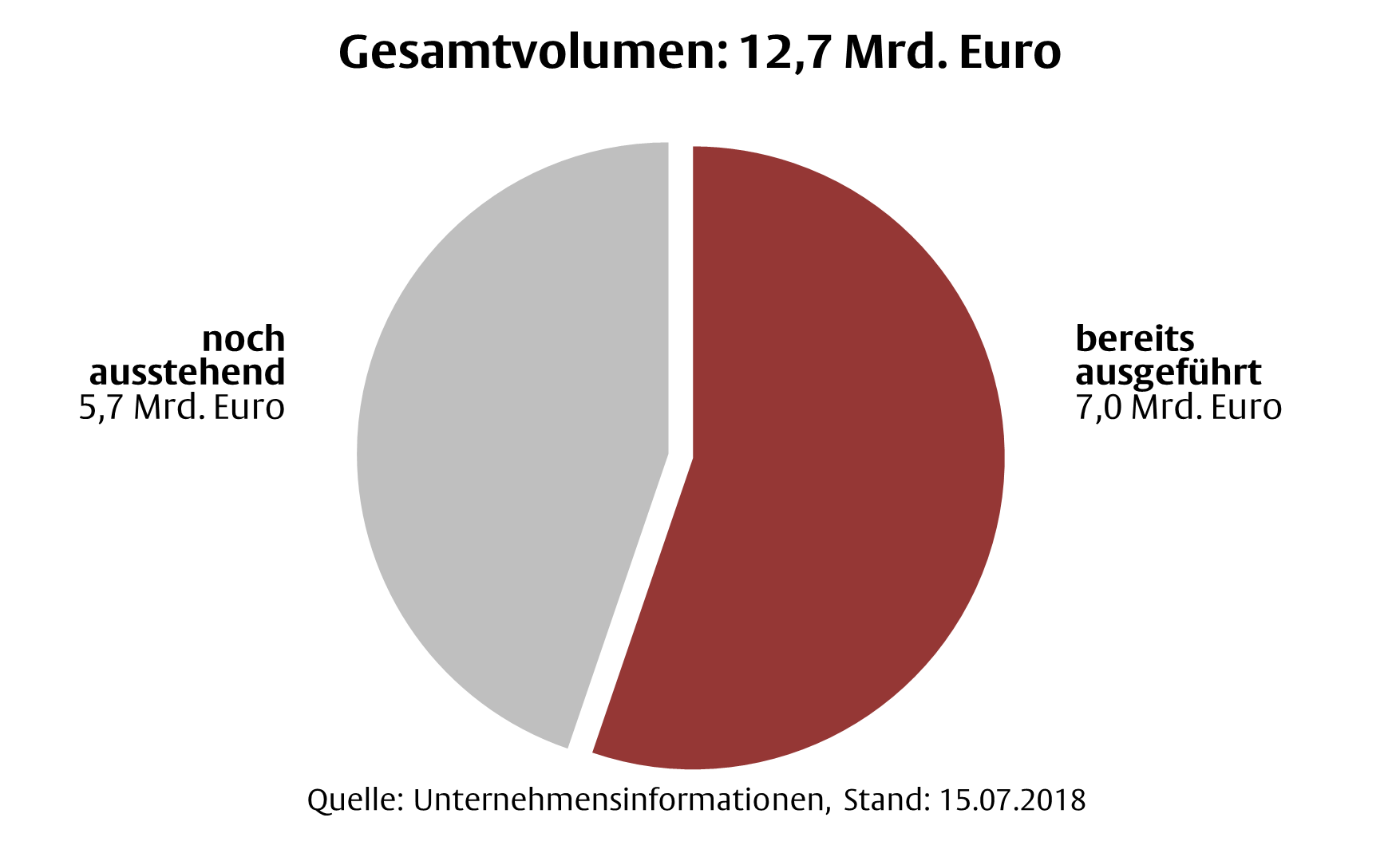

Share buybacks by major German companies are currently heading for a new 10-year high. 5.7 billion euros have been invested in current buyback programs and a further 7.0 billion euros have already been announced. The current buyback programs therefore amount to EUR 12.7 billion. It cannot be ruled out that further companies will join in and that the total volume will increase even further.

Warum entscheiden sich deutsche Unternehmen aktuell für Aktienrückkäufe und gegen Investitionen, Zukäufe, Schuldentilgung oder eine Sonderdividende?

Ein Blick auf das Marktumfeld zeigt, dass Investitionsaktivitäten jüngst nicht besonders hoch und die Unternehmen hingegen eher akquisitiv unterwegs waren. Allerdings stellt sich angesichts der fortschreitenden Digitalisierung, künstlicher Intelligenz, autonomem Fahren, etc. die Frage, ob die Bandbreite an Investitionsmöglichkeiten wirklich ausgeschöpft ist. Nur wer hinreichend in neue Strategien, Technologien oder Personal investiert, hat später die Chance, die Früchte zu ernten. Haben wir es vielleicht eher mit mangelnder wirtschaftlicher Kreativität zu tun?

Kurzfristig eine höhere Dividende zu zahlen, ist kein beliebtes Mittel. Sie müsste ohnehin erst von der Hauptversammlung genehmigt werden, welches dem Management die Flexibilität nimmt. Auch möchte man nicht, dass die Dividendenzahlungen volatil sind.

Das niedrige Zinsniveau hat Anleihenkurse stark steigen lassen und die Zinsbelastung deutlich gesenkt. Schulden vorzeitig zu tilgen ist daher entweder teuer oder bringt keine besondere finanzielle Entlastung.

So scheinen Aktienrückkäufe das Mittel der Stunde zu sein. Man darf gespannt erwarten, wie viele Unternehmen sich noch einreihen werden und zu Aktienrückkäufen greifen werden. Der letzte Rückkauf-Höchststand wurde im Jahr 2008 mit 16 Mrd. Euro erreicht. Damals wurden kurz vor der Krise die eigenen Titel zu Höchstpreisen erworben. Bereits kurze Zeit später brachen die Kurse ein. Es fehlte anschließend an liquiden Mitteln und einige Unternehmen mussten sogar Kapital neu aufnehmen, also den Kuchen in noch mehr Stücke aufteilen. Ein ungünstigeres Timing für Rückkäufe war im Nachhinein kaum denkbar.

So bleibt zu hoffen, dass Warren Buffett die Wetterlage an den Kapitalmärkten richtig einschätzt und das aktuelle Marktumfeld tatsächlich für Aktienrückkäufe optimal ist. Solang dies gut läuft, freuen sich Unternehmen und Anleger über ein größeres Stück des Kuchens.

geändert am 27.11.2020

13.04.2018 - Society & Finance

Narrative economics and the example of bitcoin

Legal notice

The information contained and opinions expressed in this document reflect the views of the author at the time of publication and are subject to change without prior notice. Forward-looking statements reflect the judgement and future expectations of the author. The opinions and expectations found in this document may differ from estimations found in other documents of Flossbach von Storch AG. The above information is provided for informational purposes only and without any obligation, whether contractual or otherwise. This document does not constitute an offer to sell, purchase or subscribe to securities or other assets. The information and estimates contained herein do not constitute investment advice or any other form of recommendation. All information has been compiled with care. However, no guarantee is given as to the accuracy and completeness of information and no liability is accepted. Past performance is not a reliable indicator of future performance. All authorial rights and other rights, titles and claims (including copyrights, brands, patents, intellectual property rights and other rights) to, for and from all the information in this publication are subject, without restriction, to the applicable provisions and property rights of the registered owners. You do not acquire any rights to the contents. Copyright for contents created and published by Flossbach von Storch AG remains solely with Flossbach von Storch AG. Such content may not be reproduced or used in full or in part without the written approval of Flossbach von Storch AG.

Reprinting or making the content publicly available – in particular by including it in third-party websites – together with reproduction on data storage devices of any kind requires the prior written consent of Flossbach von Storch AG.

© 2024 Flossbach von Storch. All rights reserved.