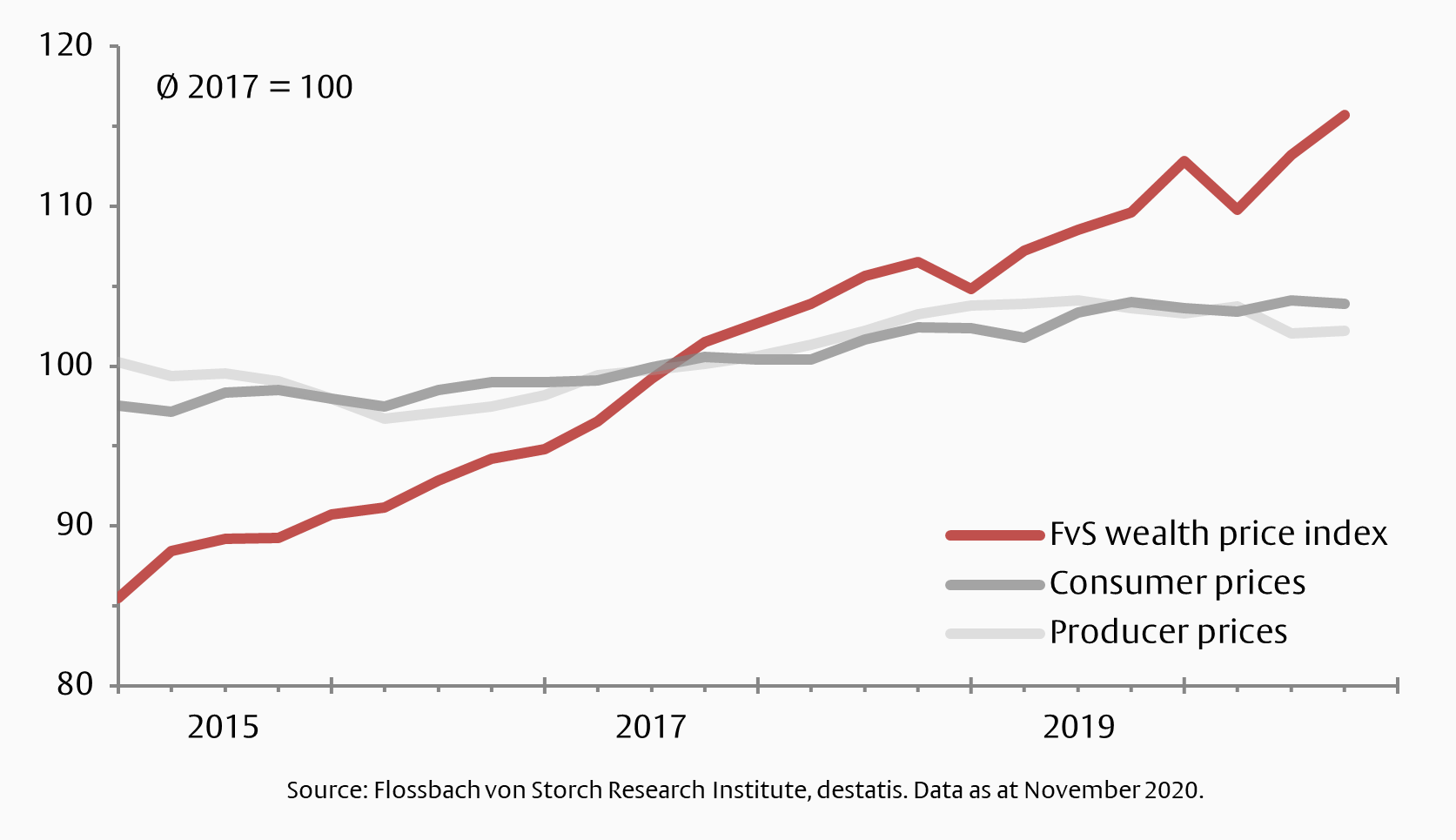

At the end of the third quarter of 2018, the prices for assets held by German households rose by 4.8%. While tangible assets and especially real estate are still on an upward trend, prices for financial assets were stagnating. Differences in both the cross-section of German households in terms of net wealth and age became significantly smaller than in previous quarters. The difference between asset price inflation and consumer price inflation, however, has fallen to 2.7 percentage points, the lowest for five years.

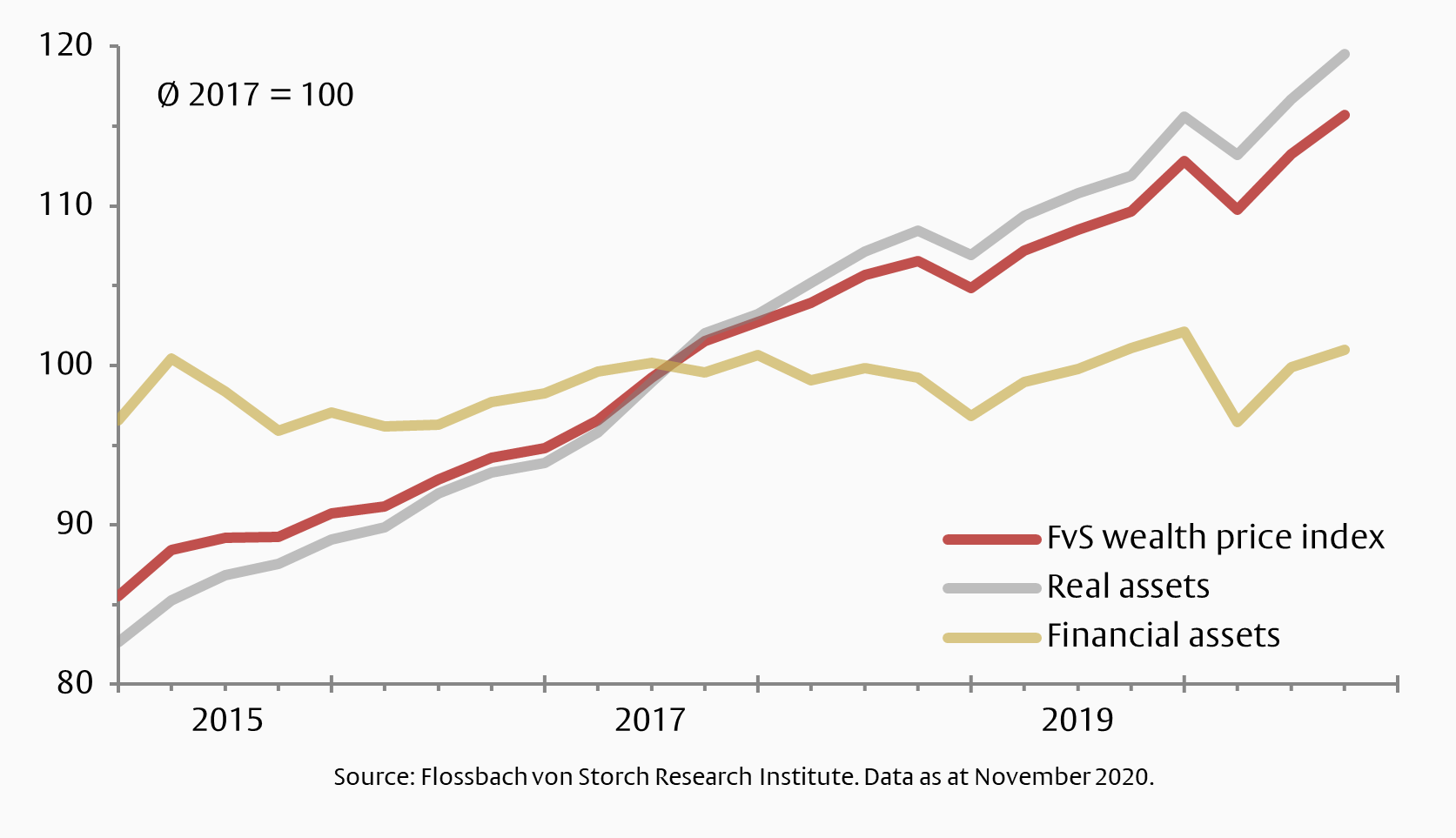

The increase of 4.8% in the asset price index compared with the same quarter of the previous year was two percentage points less than in the previous quarter and, for the first time after seven quarters, was below five per cent again. The different asset categories of German households exhibited very different inflation rates. While prices for real assets rose by 6.0%, prices for financial assets fell slightly by 0.5%.

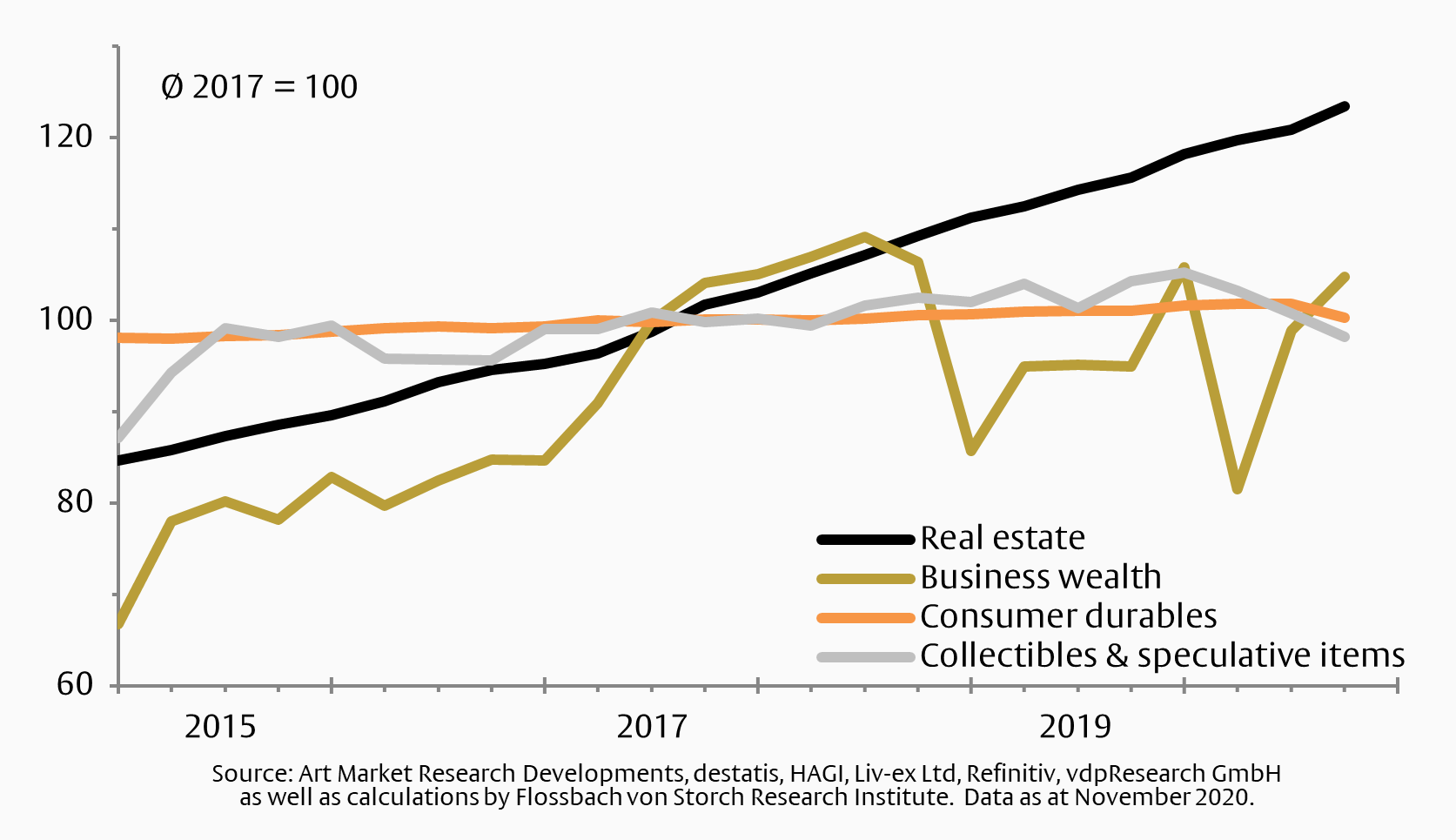

Within the category of real assets, the decisive factor continued to be the development of real estate prices, which at +7.4% remain at a very high level. Price growth for the other three categories of real assets was significantly lower, albeit positive (business wealth +2.2%, durable consumer goods +1.2%, collectors’ and speculative items +2.6%).

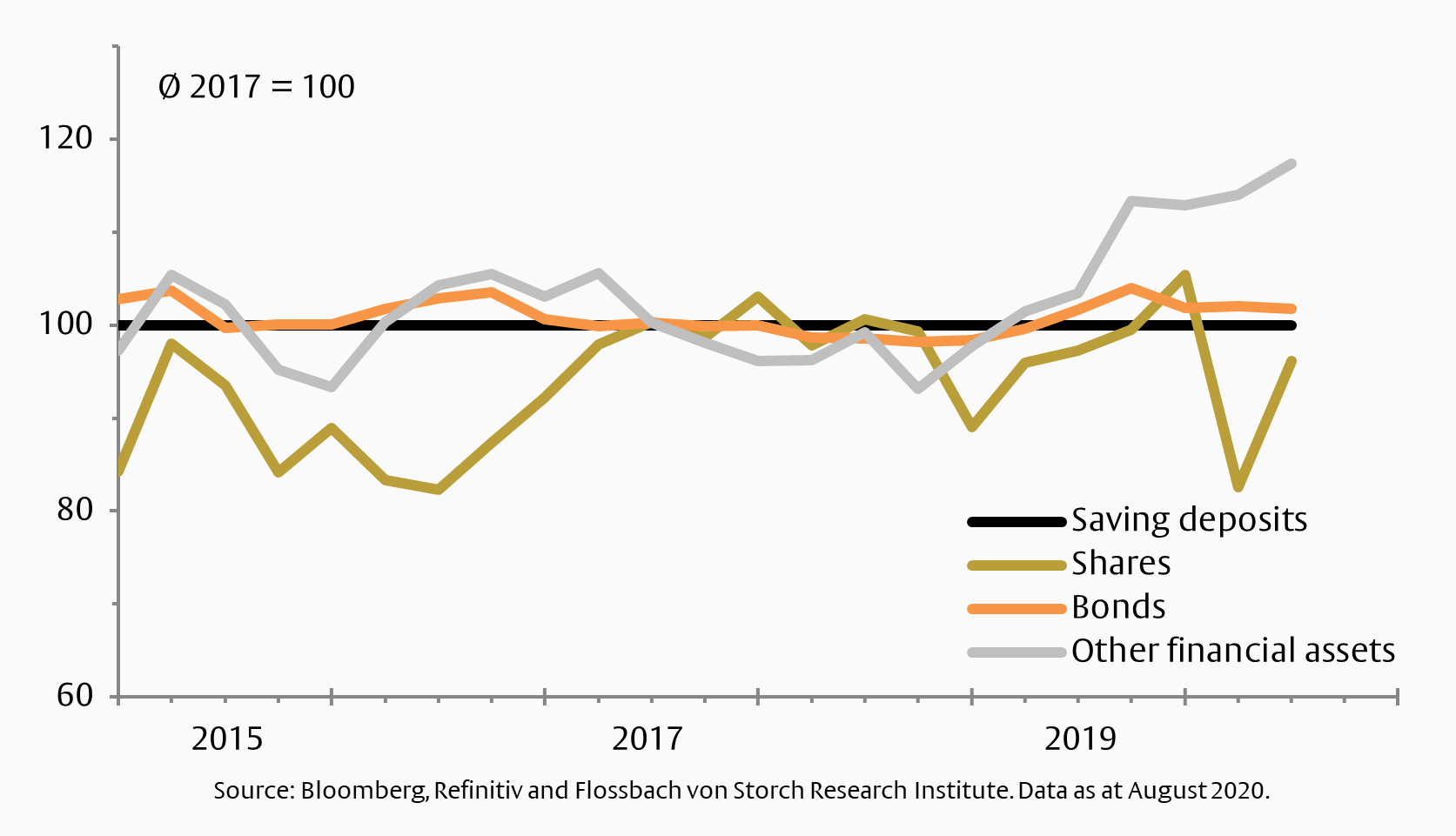

Among the financial assets, only shares showed a slight price increase compared with the same quarter of the previous year (+0.7%). Bonds became 2.2% cheaper and other financial assets (measured by gold and commodity prices) even fell by 5.4%. The price of cash holdings remained unchanged.

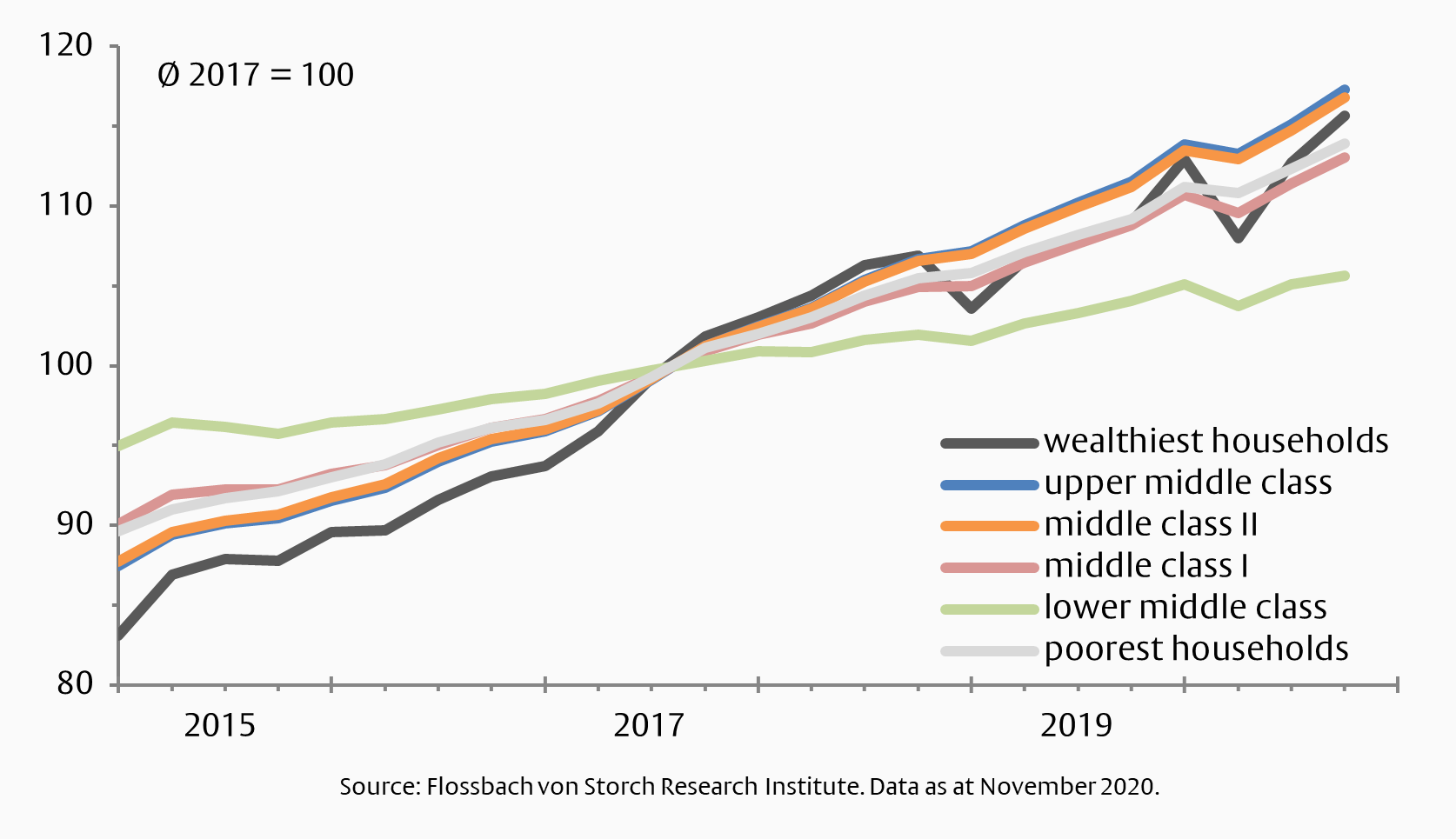

In the cross-section of net wealth, the differences between the inflation rates of the various household quantiles have not been so small for a long time. While the assets of lower middle-class households rose by only 2.1% in price, the price growth rates for all other asset groups ranged between 4.2% and 5.3%. One of the reasons for this was the low inflation rate on business wealth. In the preceding quarters, price growth rates varied by up to 7.9 percentage points in the cross-section of net wealth.

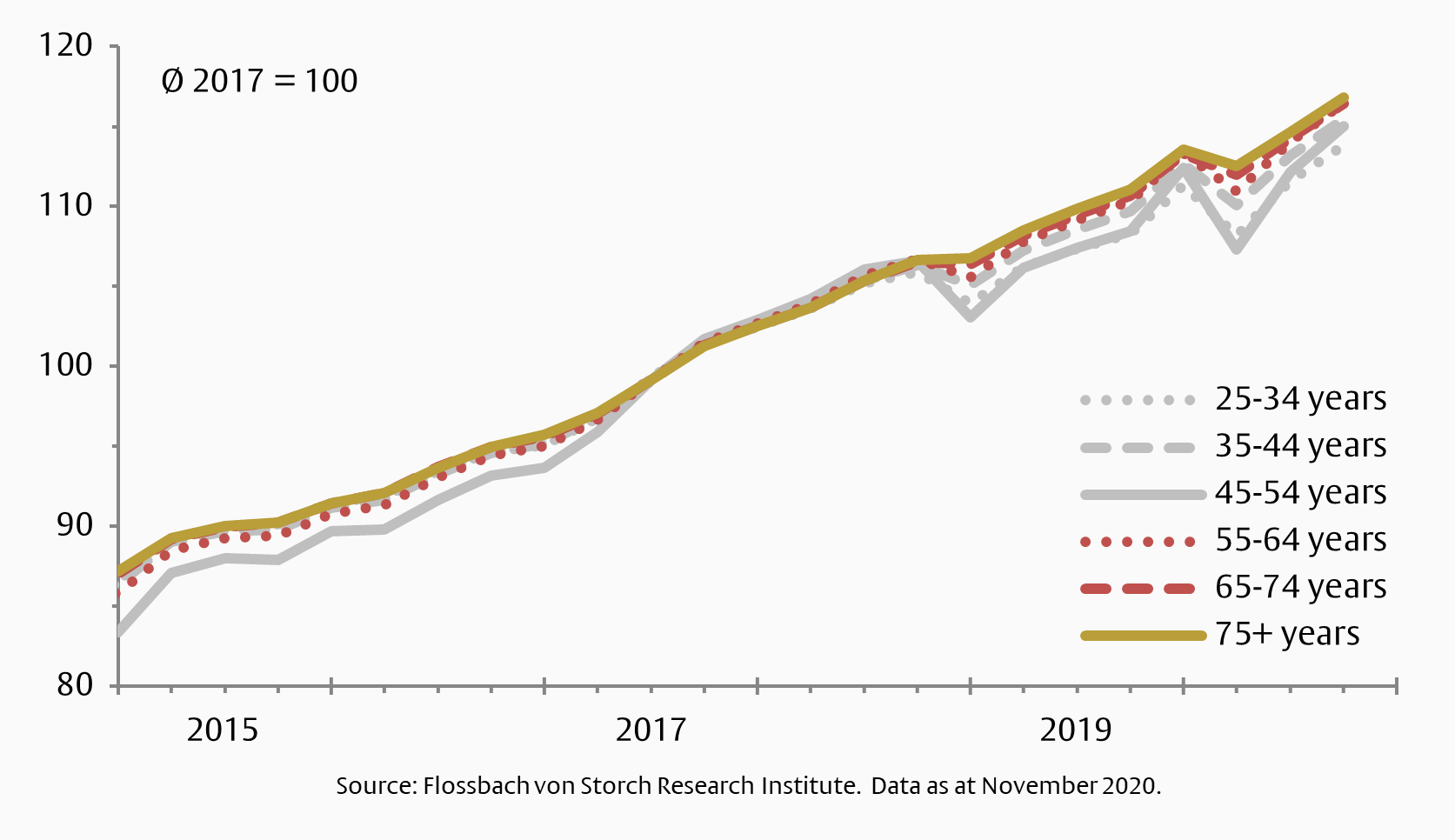

In the cross-section of age, the dynamics of inflation rates are also declining. The price growth rates for the assets of all age groups were close to each other and differed only by a maximum of 0.8 percentage points. At 5.2 %, old-age pension households showed the highest annual growth rate. In previous quarters, the highest growth rates were always found in households close to retirement.

The consumer price index rose by 2.1% at the end of the third quarter and producer prices by 3.1%. Thus, the gap to the wealth price index was also significantly smaller than in previous quarters.