15.02.2019 - Studies

The share of net bad loans over total loans is falling, but gross bad loans in absolute terms continued to rise, implying that the source of bad debt – most likely due to structural weaknesses of the economy – has not been tamed. Moreover, the economic downturn is becoming increasingly visible and political forces have also the potential to disturb the ongoing recovery. All this could challenge the Italian banking system again.

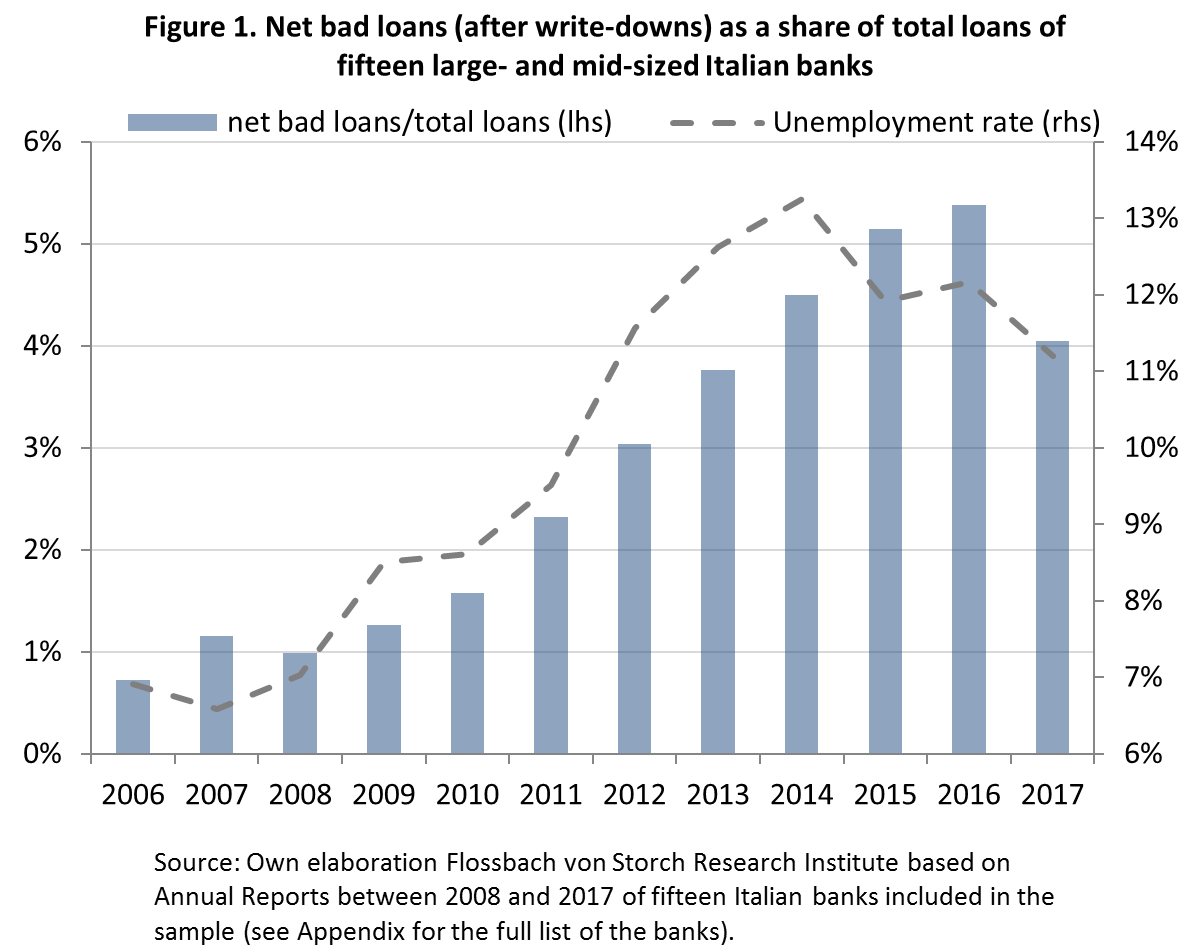

The share of net bad loans over total loans in fifteen large- and mid-sized Italian banks peaked in 2016 and fell in 2017 for the first time since 2008 (Figure 1). This was partly due to a slight decline in the stock of bad loans and – even more so – a much faster increase in total loans.

As discussed in two previous notes1, the economic explanation for both developments – the slight decline of bad loans and the fast increase in total loans – lies in a good momentum in the business cycle, visible in a moderate decline of the unemployment rate (Figure 1).

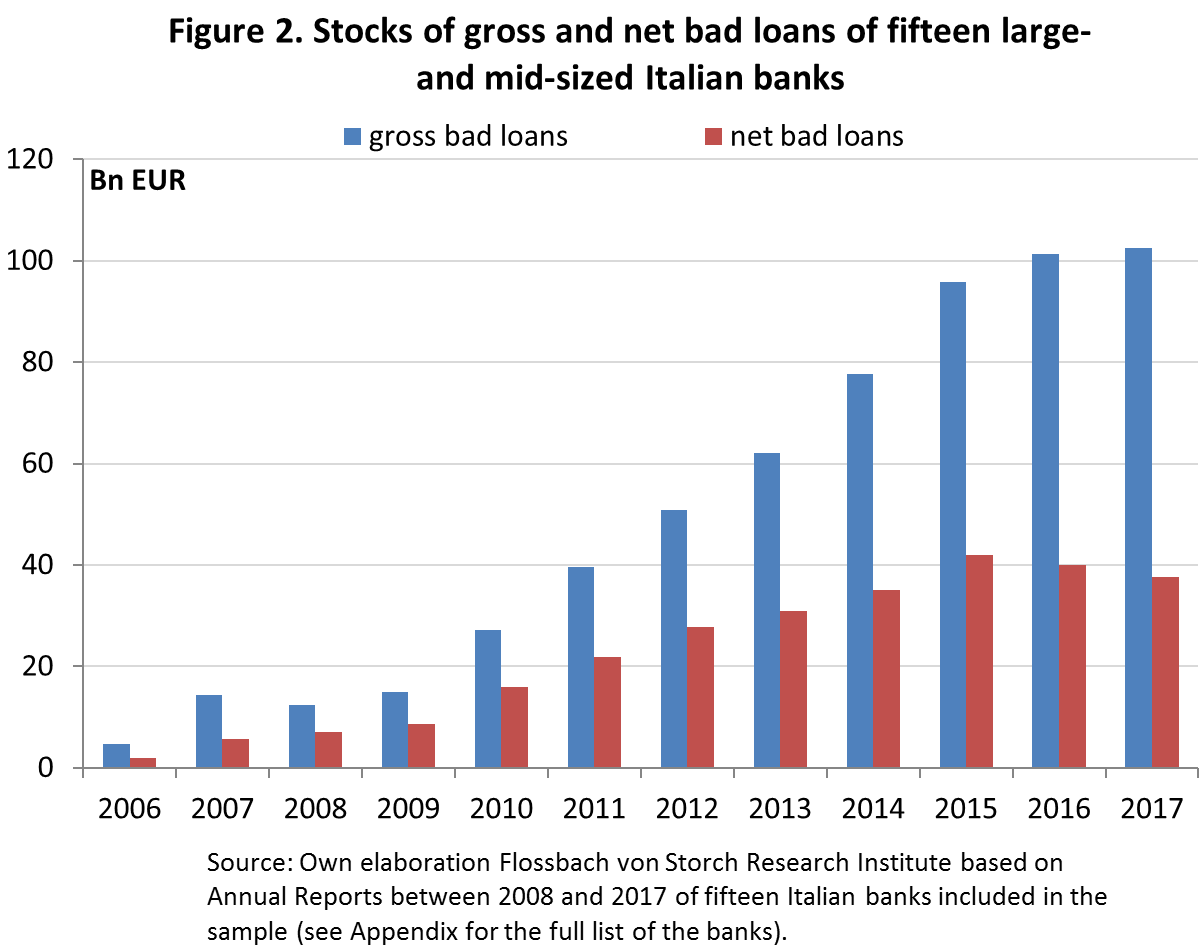

In absolute terms, the stock of net bad loans (after write-downs) decreased from a peak of 41.9 billion Euro in 2015 to 37.6 billion Euro at the end of 2017.2 However, gross bad loans continued to rise, reaching 109 billion Euro in 2017 (Figure 2). This implies that the source of bad debt – most likely due

to structural weaknesses of the economy, as implied by the still high rate of unemployment – has not been tamed and, moreover, an increasing amount of write-downs is needed to keep up with the current pace of net reduction.

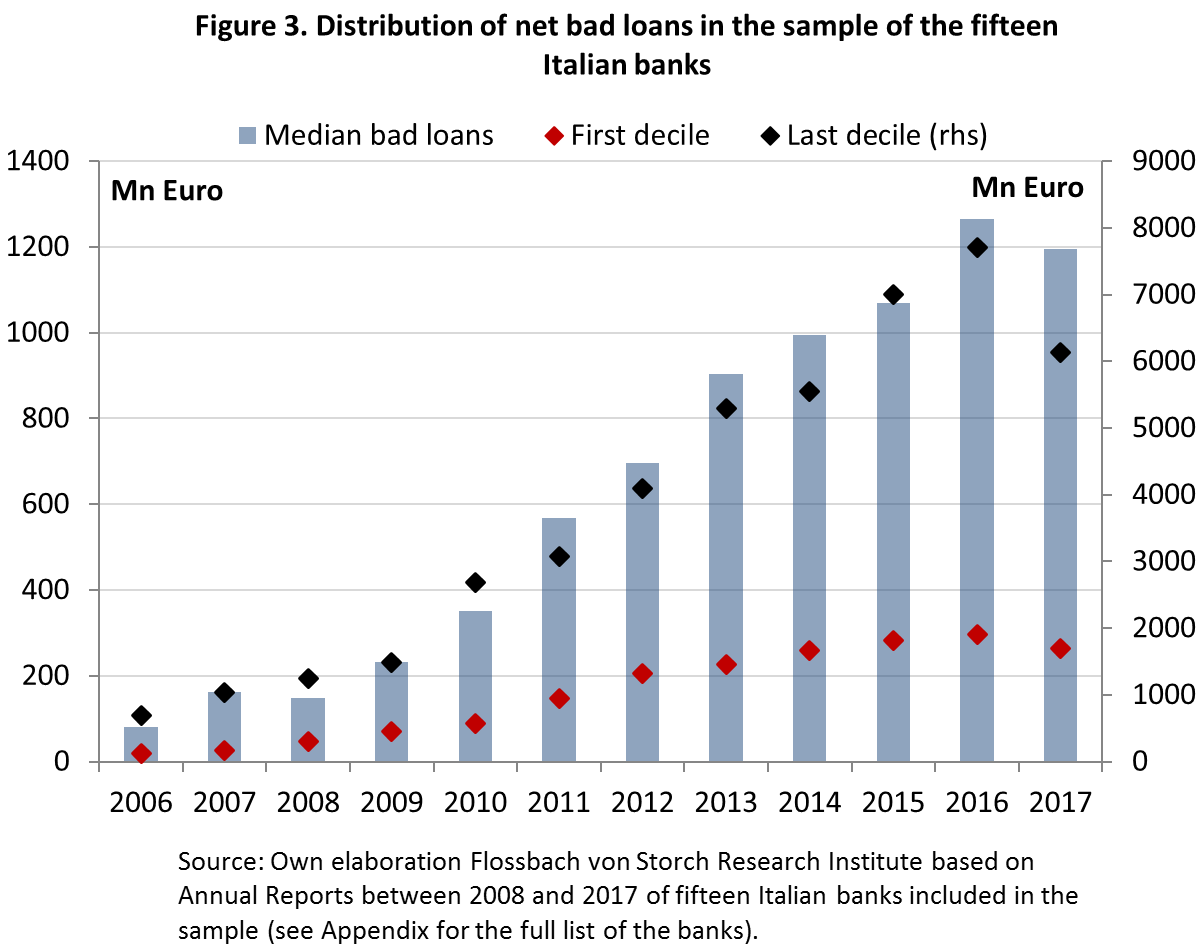

Moreover, the dispersion in distribution of net bad loans in the sample of the largest fifteen Italian banks is relatively high, implying that the pain of low credit quality is unevenly spread within the banking system. Accordingly, the stock of net bad loans in the last decile of the distribution is now over 22 times higher than in the first decile and five times higher than at the bank with the median stock of bad loans (Figure 3). Almost 50% of total net bad loans stay on the balance sheets of the three banks with the largest amounts of net bad loans, which are also the banks with the largest balance sheets.

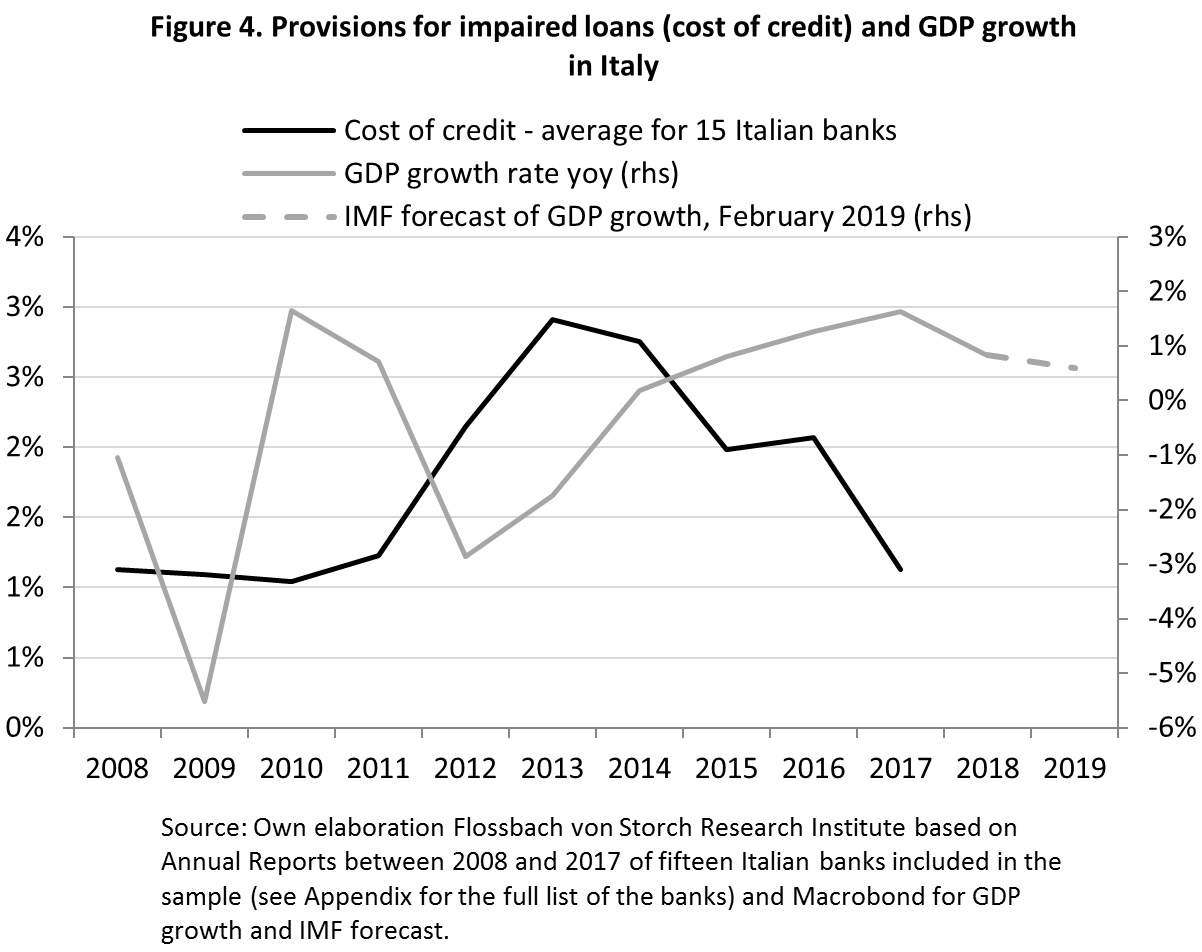

Altogether, progress in the write-off of bad loans is undeniable. However, the remaining stock of both gross and net bad loans is still substantial. This is all the more troublesome given the economic slowdown in Italy starting in 2018, preceded by a four-year period of diminishing provisions for impaired loans (so called cost of credit, see appendix for methodological details) (Figure 4). As we discussed in a previous note, this trend in loan loss provisions is due to an accounting mechanism which prompts banks to behave pro-cyclically.3 Banks strongly reduce their loss provisions in good times, but are not able to increase them – as they should – in periods of economic slowdown. A first manifestation of this phenomenon was visible in 2009, as credit provisions remained at very low levels despite the economic recession. This is likely to challenge the Italian banking system again, given the increasingly visible economic downturn.

Political forces have also the potential to disturb the ongoing recovery of Italian banks. As a reaction to the ECB’s (not binding) recommendation from January 2019 to cover not only new but also existing non-performing loans (NPLs) within seven years, Italy’s deputy prime minister Matteo Salvini accused the ECB of exerting unfair pressure on Italian banks to increase loan loss provisions.4 This comes after the diplomatic success of Italy in October 2018, when the EU member states softened draft legislative rules for banks’ NPLs, proposed by the European Commission in March 2018.5

To sum up, despite the visible progress made by Italian banks to shed the existing stocks of bad loans, the risks to the ongoing recovery have increased recently. In particular, the current mix of economic and political factors is not supportive for the medium-term outlook of the Italian banking sector.

Based on the size of individual bank’s total assets above €10 billion as of December, 31 2017, we analysed balance sheets of 15 Italian banks: 1)Unicredit, 2)Intesa Sanpaolo, 3)Banco Popolare di Milano, 4)UBI Banca, 5)Banca Nazionale del Lavoro, 6)BPER Banca, 7)Crédit Agricole Italia, 8)Credito Emiliano, 9)Banca Popolare di Sondrio, 10)Banca Carige, 11)Credito Valtellinense, 12)Deutsche Bank Italia, 13)Banca Popolare di Bari, 14)Banca Sella, 15)Unipol Banca. These are the largest Italian banks (parent companies or large subsidiaries of foreign banks, as is the case for Credit Agricole, Deutsche Bank and Banca Nazionale del Lavoro) with the main business consisting in the loans provision. Consequently, we had to exclude some large banks (ICCREA and Cassa Depositi e Prestiti) having another business focus. Finally, we excluded Banca Mediolanum due to a substantial change in accounting standards, which occurred starting in 2014. The list of banks was constructed based on the report “Le principali banche italiane” by Mediobanca and on Bloomberg data.

We did not consider the two Veneto banks (Banca Popolare di Vicenza and Veneto Banca), since they become insolvent in summer 2017 and are no longer existent. We also excluded another problematic bank, Banca Monte dei Paschi di Siena, which has been struggling for some time to avoid insolvency and was finally overtaken by Banco Popolare di Milano at the end of 2016.

When calculating the cost of credit, we used the definition applied by the majority of banks, i.e. net impairment losses on loans (reported under item 130 (a)) as a share of net total loans to customers. However, some banks preferred a slightly different concept, namely, the cost of risk. The difference with respect to the cost of credit is that net loan loss provisions are adjusted for some other items (in the case of Unicredit it is item 100 (a) – profits (losses) on disposal or repurchase of loans and item 130 (d) – net losses/recoveries on impairment of other financial activities). However, the adjustment is marginal so that the two concepts – cost of credit and cost of risk – correlate strongly. To remain consistent, we adopted the cost of credit across our sample. Finally, in the case of Unicredit, we considered the net loan loss provisions for 2016 net of the extraordinary provisions made under the two projects launched in 2016, PORTO and FINO.

Contrary to the approach of the Bank of Italy, we concentrated on the individual accounts of the banks, rather than on consolidated accounts of the group. In this way, we obtain a non-diluted picture of the actual situation of each single bank.

1 Gehringer, A. (2017), “Monte dei Paschi is only the tip of the iceberg”, Flossbach von Storch Research Institute, Economic Policy Note 12/6/2017; Gehringer, A. (2016), “Non-performing loans in the euro periphery were not build in a day”, Flossbach von Storch Research Institute, Economic Policy Note 28/10/2016.

2 The sample of the 15 banks covers around 71% of bad-loan exposures of the total considered by the Bank of Italy (see Financial Stability Report of the Bank of Italy from October 2018 for more details).

3 The combination of two inaccuracies in the credit risk assessment, namely, over the entire credit portfolio and with respect to each individual borrower leads to a pro-cyclical provisioning for credit losses: provisions diminish in the upswing, although the stock of problematic loans might be still high, the structural financial conditions of single borrowers do not change and the supply of new credit increases. For more details, see Gehringer, A. (2018), “Delusive security in the Italian banking sector”, Flossbach von Storch Research Institute, Economic Policy Note 15/01/2018.

4 Matteo Salvini in his statement cited by newswire Ansa: „The new attack by the ECB supervisor on the Italian banking system and Monte dei Paschi shows once again that the banking union (…) not only does not make our financial system more stable, but it causes instability.“

5 These rules regard the new coverage schedule for new loans turning out to be non-performing. States supported the extension to three years – from two – of the time during which new unsecured NPLs would have to be covered with a backstop. For loans with movable collateral the time to set aside funds to cover the future NPLs was actually cut from eight to seven years – in a concession to countries requiring stricter rules. Moreover, the postponement of the application of the new requirements was also agreed: from the initially planned starting date in March 2018 to the date on which the new rules are effectively adopted. But the entry into force is still unsure, given that the proposal still needs approval of the EU parliament.

Legal notice

The information contained and opinions expressed in this document reflect the views of the author at the time of publication and are subject to change without prior notice. Forward-looking statements reflect the judgement and future expectations of the author. The opinions and expectations found in this document may differ from estimations found in other documents of Flossbach von Storch AG. The above information is provided for informational purposes only and without any obligation, whether contractual or otherwise. This document does not constitute an offer to sell, purchase or subscribe to securities or other assets. The information and estimates contained herein do not constitute investment advice or any other form of recommendation. All information has been compiled with care. However, no guarantee is given as to the accuracy and completeness of information and no liability is accepted. Past performance is not a reliable indicator of future performance. All authorial rights and other rights, titles and claims (including copyrights, brands, patents, intellectual property rights and other rights) to, for and from all the information in this publication are subject, without restriction, to the applicable provisions and property rights of the registered owners. You do not acquire any rights to the contents. Copyright for contents created and published by Flossbach von Storch AG remains solely with Flossbach von Storch AG. Such content may not be reproduced or used in full or in part without the written approval of Flossbach von Storch AG.

Reprinting or making the content publicly available – in particular by including it in third-party websites – together with reproduction on data storage devices of any kind requires the prior written consent of Flossbach von Storch AG.

© 2024 Flossbach von Storch. All rights reserved.