At the end of the first quarter of 2024, prices for the assets of private German households had fallen by -1.3% compared to the same quarter of the previous year. Over the past four quarters, the development took place in two phases, which were characterized by the development of key and market interest rates. In the first three quarters, asset prices fell due to expectations of rising interest rates. In the most recent quarter (Q1-2024), prices stabilized (+0.5%) as interest rates did not rise and the expectation of falling interest rates in the future arose.

The expansionary monetary policy pursued by the ECB and the FED until 2022 caused asset prices in Germany to rise sharply. This was primarily transmitted via the interest rate channel, as the low interest rate policy lowered both short and long-term interest rates, causing prices for real estate, shares, business wealth and bonds to rise. When the ECB and the Fed ended their expansive monetary policy and adopted a restrictive course to curb consumer price inflation, this immediately had a negative impact on asset prices such as shares and bonds in Germany. Real estate prices, on the other hand, reacted with a delay and to a lesser extent.

Over the past four quarters, the change in expectations regarding future interest rate hikes by the Fed and the ECB was reflected in prices. While interest rate hikes were both expected and realized in the second quarter of 2023, the last rate hike was implemented by the ECB in September 2023. As consumer price inflation in the eurozone fell and economic growth weakened, the expectation of further interest rate hikes diminished and the narrative of falling interest rates in the future emerged. As a result, asset prices such as shares, bonds and business wealth rose in the fourth quarter of 2023. The latest expectations of possible interest rate cuts have so far had only a minor impact on real estate prices.

The Flossbach von Storch (FvS) Wealth Price Index measures the price development of the assets held by German households. The index corresponds to the weighted price development of real and financial assets owned by German households. Real assets consist of real estate (64%) and business wealth (12%) as well as consumer durables (3%) and collectibles and speculative items (<1%). Financial assets are broken down into savings and demand deposits (10 %), shares (5 %), bonds (5 %) and other financial assets (<1 %). A detailed description of the methodology can be found in the appendix.

At the end of the first quarter, the price of real assets (real estate, business wealth, durable consumer goods and collective and speculative items) held by German households was -3.9% below the same quarter of the previous year. However, there were different price trends within real assets.

Prices on the German real estate market continued to fall. At the end of the first quarter, properties were trading -4.6% cheaper than in the same quarter of the previous year and only -0.4% cheaper than in the previous quarter.1 Although real estate prices are still falling, the change in the most recent quarter shows that the price decline has flattened out.

Price trends on the German real estate market are influenced by the development of key and market interest rates, as these are decisive for the level of mortgage interest rates for loan-financed property purchases. However, the long-term rather than the short-term trend is particularly important here, as real estate transactions are generally carried out over a longer period of time. The most recent fall in prices continues to be characterized by the rise in interest rates in 2022 and less by the latest expectations of any interest rate falls.

In addition to the interest rate-related price changes, construction, renovation and energy costs coupled with stricter regulations for heating systems put pressure on prices. The fall in prices was cushioned by a continuing shortage of supply and a low level of new construction activity. The current weakness in economic growth is also having an impact on commercial real estate.

Private business wealth (companies owned by private households) was +8.1% more expensive at the end of the year than at the end of the previous year. While concerns about the weak growth of the German economy were still depressing business wealth prices in the middle of last year, the stabilized interest rate level had a positive effect on business wealth prices in the second half of the year.

Price increases for consumer durables continued to slow over the past four quarters, rising by only +2.9% compared to the same quarter of the previous year. The interim price increase was due to supply chain problems and higher prices for labor, energy and intermediate products. As private households continue to have sufficient liquidity despite the weak economic growth, demand for consumer durables remained high, which supported prices.

Collectibles and speculative items increased in price by +1.1% compared to the same quarter of the previous year. The price increase was significantly lower than in the past two years. In particular, demand for works of art, historic cars and fine wines declined.

The prices of financial assets (savings and sight deposits, shares, bonds and other financial assets) were influenced by the development and expectations of interest rates. Compared to the end of the previous year, the prices of financial assets owned by private households rose by 4.4%. The two most recent quarters account for the larger part of this increase.

The equity assets of private German households increased in value by +15.2% compared to the same quarter of the previous year. More than 12 percentage points of the increase was attributable to the last two quarters alone. The price increase is less attributable to an improved earnings outlook than to changes in the interest rate environment. The rise in the price of North American stocks was particularly marked, which is due on the one hand to the expectation that the Fed will not raise interest rates and on the other to the high concentration of the US equity market, which has been dominated by a small number of stocks in recent quarters. Prices for shares in German companies rose by +12.5 %.

Price trends on the bond markets were also influenced by the expectation and development of key interest rates in Europe and the USA. Compared to the same quarter of the previous year, the price of German households' pension assets rose by 2.0%. The decisive factor for the price increase was the development in the third quarter, when expectations formed that the probability of upcoming interest rate hikes by the ECB and the Fed was falling. In the third quarter of 2023 alone, the prices of German household bonds rose by 4.1%. In the most recent quarter, however, bond prices fell by -0.7%.

The price of other financial assets, which is measured by the price of gold and commodities traded on the stock exchange, rose by +8.2% compared to the end of the previous year. The price of gold in particular rose by +11.6 %, driven by high demand from China and various central banks, among other things, while commodities rose by +3.9 %.

The prices for savings and demand deposits remain unchanged by definition.

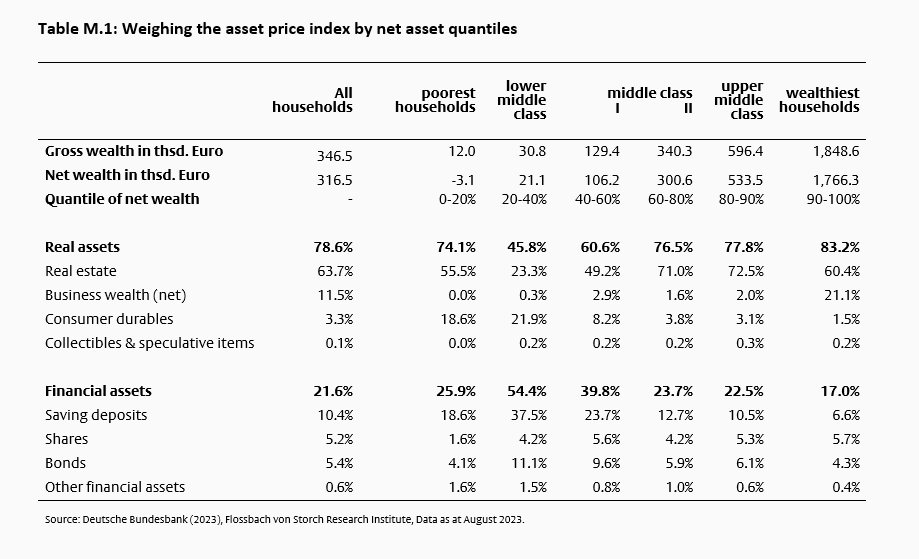

In the cross-section of the net wealth of private German households, asset prices have fallen for all groups with one exception. The wealthiest 60 % to 90 % of households according to their net wealth quantile experienced the highest price decline (-2.2 % to -2.3 %), as they own the highest proportion of real estate assets. For the wealthiest 10%, the price decline was slightly lower (-0.6%), as the high proportion of business wealth dampened the price decline. For households in the lower middle class (20% to 40%), the fall in prices was even slightly positive due to the low level of real estate assets and the high proportion of savings.

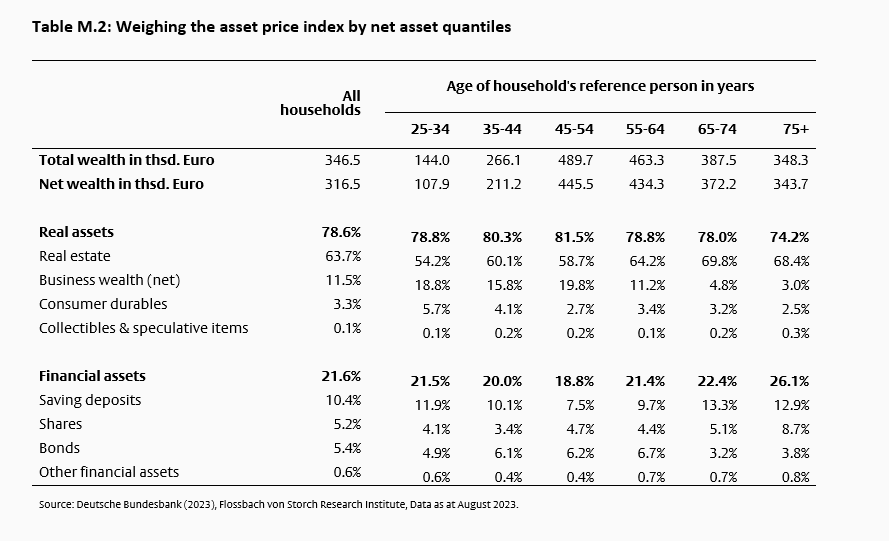

In the cross-section of household ages (measured by the age of the household's reference person), the price decline ranges from -0.5 % to -2.0 %. The price decline is highest for households over retirement age, as they very rarely have business wealth and real estate accounts for a high proportion of their assets.

The rate at which consumer prices rose in the past year has increasingly declined. While the annual rate of consumer price inflation, as measured by the Federal Statistical Office's consumer price index, was still over eight percent at the beginning of the year, by the end of the year it was only +2.5 percent compared to the end of the previous year.

Producer prices fell significantly over all four quarters, so that at the end of the year they were -3.9% below the end of the previous year.

The FvS Wealth Price Index measures the price change of assets held by German households. The index is calculated using the Laspeyres method as a weighted average of time series of indexed prices which reflect the change in the prices of assets in euro. The index is based on the average for the year 2021. Where necessary, quality-adjusted time series have been used and gains, such as interest payments, have not been taken into account. There is no valuation approach employed. For the asset class shares, for example, the share prices and not the price-earnings ratio are taken into account. This corresponds to the procedure for commodity price indices, in which only commodity prices and not the price-utility ratio are included.

The relevant assets are selected via the study "Private Haushalte und ihre Finanzen" (PHF) of the Deutsche Bundesbank (2023). The weighting scheme of the time series is based on the survey results of the 2021 PHF study and corresponds to the share of assets in the total assets of German households. The composition of household assets in the cross-section of the population across wealth and the age of the household members is very heterogeneous. Therefore, the FvS Wealth Price Index is additionally calculated for different quantiles of the distribution of net wealth of German households (total wealth less liabilities) and for different age groups (measured by the age of the reference person of the household).

The assets of a household are divided into various sub-groups of real assets and financial assets. Real assets include real estate, business wealth (net), consumer durables, and collectors' and speculative items. Financial assets include savings deposits, shares, bonds and other financial assets. Assets in the form of funds units and credit balances under cash value insurance contracts are allocated to the aforementioned components according to their respective composition.

The price development of real estate assets is recorded by the VDP real estate price indices of vdpResearch GmbH. For owner-occupied residential property, the "owner-occupied homes" and "owner-occupied apartments" indices are weighted accordingly. For other properties, the development of the capital value of apartment buildings, office properties and retail properties is used and weighted accordingly. For indices that are only available during the year from 2008 onwards, quarterly values prior to 2008 are approximated using average annual growth. The resulting price index for real estate assets corresponds to the indices for owner-occupied and other properties weighted according to the distribution of assets.

Private business wealth comprise all non-publicly traded participations of private households. The price development is approximated by the SDAX price index of Deutsche Börse, which records prices for medium-sized companies. The SDAX price index reflects the price development of 50 publicly traded companies in traditional industrial sectors that follow the MDAX-listed stocks in terms of market capitalisation and stock exchange turnover.

In order to measure the price development of durable consumer goods such as vehicles and furniture, the corresponding components of the consumer price index are used by destatis (Federal Statistical Office). The relative weighting is based on the respective weight in the consumer price index.

The price development of collectors' and speculative items is measured equally by the four representative goods categories jewellery, artworks, historical automobiles and precious wines. Jewellery prices are measured using the "Schmuck aus Edelmetallen" component of the consumer price index. The Artprice Global Index from Artprice.com is used to track price developments on the art market. This price index is based on auction prices for paintings, sculptures, drawings, photographs, prints, aquarelles and similar items. The HAGI Top Index of the Historic Automobile Group International (HAGI) is used to measure the prices of historic automobiles. The index tracks the price development of 50 rare historical automobile types based on a database of transactions covering more than 18,000 individual vehicles. Quarterly values prior to 2009 are based on an equally weighted recalculation interpolating during the year. The price development of precious wines is measured with the Liv-ex Fine Wine 100 published by the trading platform Liv-ex Ltd. The index measures the price development of the premium segment of the wine market for wines for which a secondary market exists. The index primarily includes Bordeaux wines, but also wines from the wine growing regions of Burgundy, Rhône, Champagne and Italy.

Since saving/sight deposits are not subject to a price directly, they are assumed not to show any price changes and are therefore modeled by a constant time series. This category includes, inter alia, current, savings, fixed-term and call money accounts, balances on building savings and non-governmental pension contracts and claims on other households.

The price development of shares is recorded by various share price indices. Using data from the Coordinated Portfolio Investment Survey (CPIS) of the International Monetary Fund (IMF), the geographical weighting of German equity investments is determined and, based on this, MSCI price indices are weighted accordingly.

Similar to the procedure for equity investments, the geographical distribution of bond investments is determined using data from the IMF and the Bank for International Settlements (BIS). The price development is calculated using the corresponding bond price indices from Barclays Bank PLC. Both government and corporate bonds with different credit ratings and residual maturities are taken into account.

Other financial assets, which are not covered by the three previous categories, are measured by the development of gold and commodity prices. The Rogers International Commodity Index is used for the price development of commodities, which reflects the price development of futures on various commodities. The price of gold is determined via the London Bullion Market.

The capital, which is bundled in insurance contracts and funds, is allocated on the basis of data provided by the German Insurance Association (GDV) and the Federal Association for Investment and Asset Management (BVI).

In the case of time series with daily values, the average end-of-day index status of the last quarter month is always used. For indices available monthly, the last monthly value in the quarter is used.

Revision of historical data of the underlying time series may result in a deviation of the historical index values from previous publications.

Publication dates

The index values of a quarter are published as follows:

First quarter: 15 May

Second quarter: 15 August

Third quarter: 15 November

Fourth quarter: 15 February of the following year

If the date falls on a weekend or a public holiday, publication will take place on the next working day.

List of data sources

Art Market Research Developments Ltd.

Bank für Internationalen Zahlungsausgleich (BIZ)

Barclays Bank PLC

Bundesverband Investment und Asset

Management (BVI)

Deutsche Bundesbank

destatis – Statistisches Bundesamt

Gesamtverband der Deutschen Versicherungswirtschaft (GDV) e.V.

Historic Automobile Group International (HAGI)

Internationaler Währungsfonds (IWF)

Liv-ex Ltd

ThomsonReuters

vdpResearch GmbH