STUDY. The EU is scaling back its sustainability reporting requirements. What DAX and MDAX companies think about this.

A rollback of regulations by the European Union (EU)? According to attentive observers of the Brussels scene, this has allegedly never happened before – until the end of 2025. On 16 December, the EU Parliament voted in favour of simplifying corporate sustainability reporting.1 The EU named the corresponding directive the Corporate Sustainability Reporting Directive (CSRD). The CSRD has a strong influence on which companies are required to report on ESG (environment, social, governance) and how detailed the information should be.

A survey by the Flossbach von Storch Research Institute, which forms the core of this study, shows how companies listed on the German stock index (DAX) and its smaller counterpart, the MDAX, are likely to deal with the significantly changed requirements.

CO2, social issues, corporate governance

The CSRD lays down strict rules on how companies must report on their efforts to reduce CO2 emissions. It also requires information on social issues and corporate governance. All companies that were already covered by the predecessor, the Non-Financial Reporting Directive (NFRD), are directly affected by the CSRD. Across the EU, this amounted to 11,700 large companies.

With the NFRD, the EU introduced reporting requirements for "public-interest entities" on 1 January 2017. Since then, companies, banks and insurance companies with more than 500 employees have been required to demonstrate "transparent and responsible business conduct and sustainable growth" and to comment on "social responsibility". Since then, companies have been required to disclose "information on sustainability, such as social and environmental factors" in order to "identify risks to sustainability and strengthen investor and consumer confidence".

The CSRD, adopted by the EU in January 2023, replaced the NFRD. It is important to note that the new CSRD rules have one thing in common with the NFRD rules they replaced: the concept of "double materiality". According to this concept, companies must not only disclose the sustainability aspects of their business model, but also assess how their business activities impact people and the environment.

Twelve reporting standards

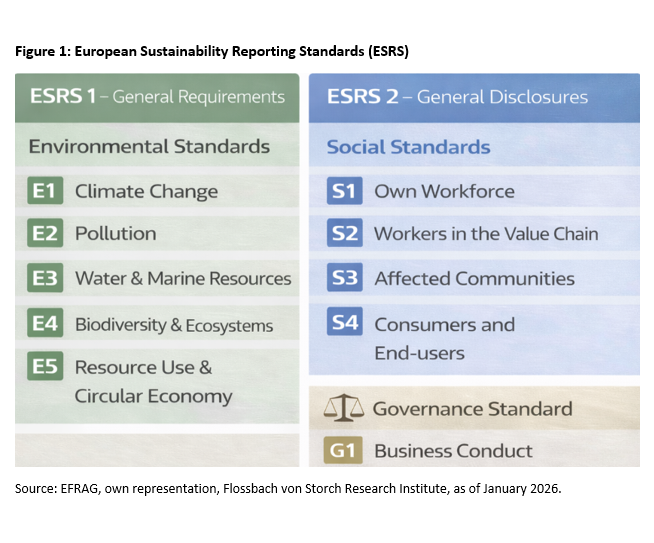

In terms of content, the implementation of the CSRD is governed by the European Sustainability Reporting Standards (ESRS) , which the EU introduced on 1 January 2024. The ESRS were developed by the EU-affiliated association EFRAG (formerly: European Financial Reporting Advisory Group). The ESRS are a result of the European Green Deal and the EU's efforts to channel capital into supposedly sustainable activities. The ESRS require disclosures across the entire value chain, including greenhouse gas emissions, human rights risks and suppliers.

However, the companies affected are also regularly subject to other ESG reporting requirements, such as the IFRS Sustainability Disclosure Standards (IFRS SDS), which were developed from the International Financial Reporting Standards (IFRS) applicable to European capital market-oriented companies. The EU also has a say in the IFRS SDS through EFRAG. The aim is to closely align the two sets of rules in order to avoid (too much) duplication of work for companies and auditors. The ESRS also incorporates global standards that are not mandatory for companies, such as the Task Force on Climate-related Financial Disclosures (TFCD) and the Global Reporting Initiative (GRI).

The first version of the ESRS consists of two cross-cutting standards (ESRS 1 and ESRS 2) and ten thematic standards (E, S and G, Figure 1).

The EU has postponed sector-specific ESRS and standards for foreign corporations with European subsidiaries until 30 June 2026.

In Germany, the Commercial Code (HGB) serves as the legal basis into which the CSRD Directive will be incorporated. The latest deadline for the adoption of the CSRD in EU countries was 6 July 2024. This meant that companies in this country should have applied the CSRD retroactively as of 1 January 2024. Should have, because the old traffic light coalition government and, to date, the subsequent grand coalition of CDU/CSU and SPD have failed to incorporate the CSRD into German law.

Even though the CSRD is still not applicable de jure, listed companies in particular have taken the requirements of the European Sustainability Reporting Standards into account in their annual reports – for the first time for their 2024 financial year. According to a recent survey of 36 out of 40 DAX companies, three-quarters had voluntarily submitted a fully CSRD-compliant sustainability report for their 2024 financial year; one-quarter prepared the report "based on the ESRS" (Juppe, Orth, Mayer, Marten 2026).

New framework

After the introduction of the CSRD sparked massive protests from companies and lobby groups due to its complexity and scope, the European Commission launched a simplification phase. The so-called "Omnibus Initiative" comprises seven simplification packages designed to reduce bureaucracy for EU companies. Omnibus I included the CSRD and the EU Supply Chain Act (CSDDD). Both were slowed down before they were even fully implemented in Germany. "The CSRD requirements will be implemented 1:1 in the new draft implementation, and the existing legal framework will be adjusted in specific areas," according to the latest information from the Federal Ministry of Justice.2

Under the new framework, all companies with fewer than 1,000 employees and less than €450 million in annual turnover will initially be exempt from the CSRD reporting requirement. Estimates suggest that this will exempt 80 per cent of all companies that were subject to reporting requirements under the old regulations for the time being.

In Germany, however, due to the lack of a legal basis, even those companies that do not reach the thresholds of 1,000 employees and €450 million will initially continue to be subject to the old reporting requirements under the Non-Financial Reporting Directive, provided they have already belonged to this group since 2017. In addition, German SMEs are also threatened with ESG reporting requirements through the back door in the future, ironically via the Banking Directive Implementation and Bureaucracy Relief Act (BRUBEG)3. The draft law stipulates that banks will have to draw up "ESG risk plans" from 2027 onwards. To do this, they will need data from their borrowers.

A so-called "stop-the-clock rule" postpones the date of application of the CSRD for companies not yet subject to reporting requirements under the Omnibus Initiative – EU member states have their own leeway here. In principle, large companies that were not previously subject to reporting requirements will now only be required to do so for the 2027 financial year (previously: 2025). For listed small and medium-sized enterprises, the reporting requirement will also be postponed by two years (from the 2026 financial year to the 2028 financial year).

Regulations cut back

It is essential for all companies that the revised European Sustainability Reporting Standards (Draft Simplified ESRS) provide for a significant reduction of around 60 per cent in the mandatory data points across all standards.4 The ESRS data points form the basis for structured and comparable ESG disclosures. The new drafts of the ESRS have been reduced from 257 pages to 156 pages. All voluntary data points have been completely removed from the ESRS. Instead, companies can explain additional, non-mandatory content (known as NMIG = Non-mandatory Illustrative Guidance).

However, EFRAG has largely removed qualitative disclosures from the ESRS and made fewer cuts to quantitative disclosures, which are more difficult to determine. For companies, the reduction in workload is therefore likely to be significantly less than the 60 per cent reduction would suggest.

The EU has also relaxed the anchor points for potential liability issues or lawsuits. According to this, only corporations with more than 5,000 employees and annual turnover of more than €1.5 billion must fulfil "due diligence obligations". This will apply from July 2029.

The Draft Simplified ESRS are now in the legislative process of the European Commission. A further public consultation is planned before the standards are expected to be adopted in mid-2026 as a delegated act amending the currently valid ESRS. The Draft Simplified ESRS are scheduled to come into effect on 1 January 2027, possibly with an option for early application in the 2026 financial year.

Survey of DAX and MDAX companies

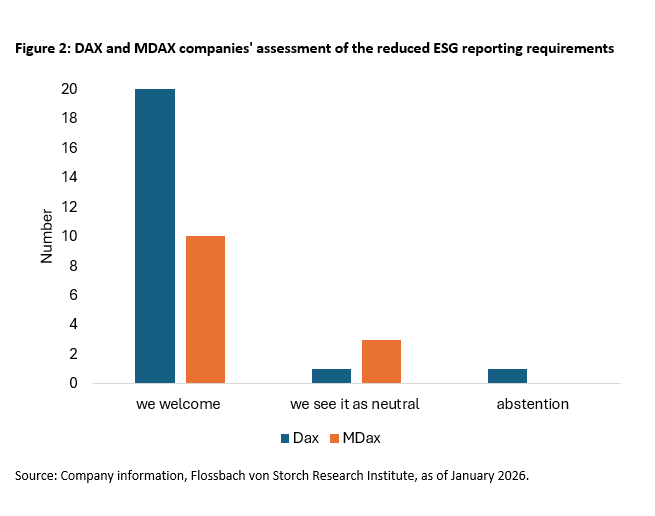

But how do German companies view the simplifications, and how do they plan to deal with them? A survey of DAX and MDAX companies shows that an overwhelming majority welcome the reductions in the ESRS (Figure 2). A total of 35 companies, or just under 40 per cent of the 40 DAX and 50 MDAX corporations surveyed, responded to standardised questions from the Flossbach von Storch Research Institute, including more than half of all DAX members (22) and a good quarter of all MDAX members (13).

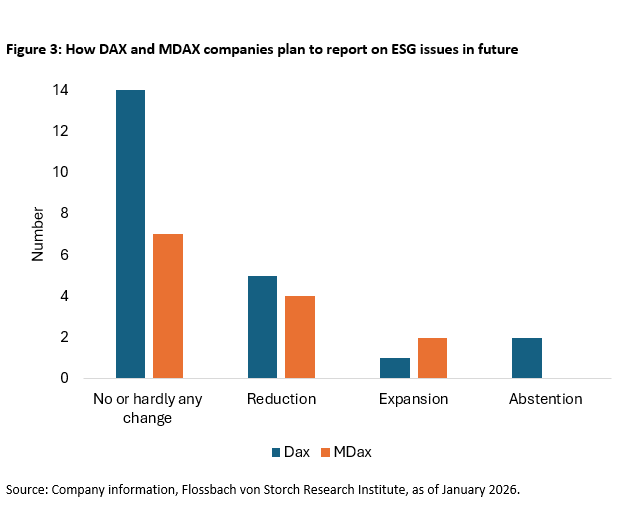

However, the future reductions planned under the ESRS are not expected to lead to a reduction in reporting in all cases. Fourteen of the DAX companies and seven of the MDAX companies surveyed will not change their reporting at all or only minimally, five of the DAX companies and four of the MDAX members plan to reduce their reporting, and one DAX company and two MDAX companies even want to expand their ESG reporting (Figure 3).

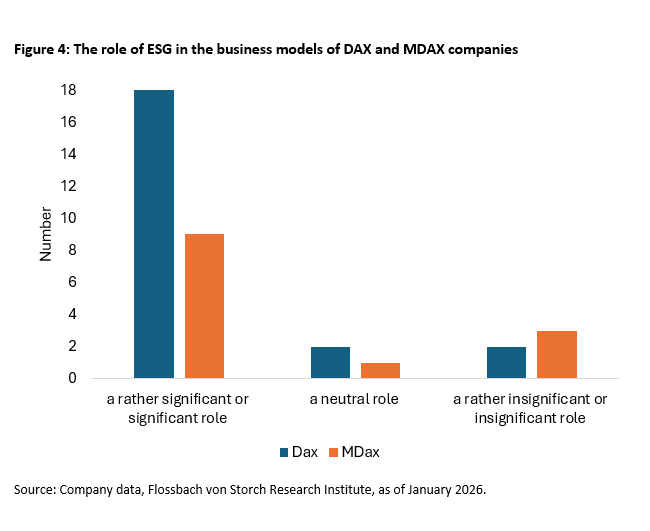

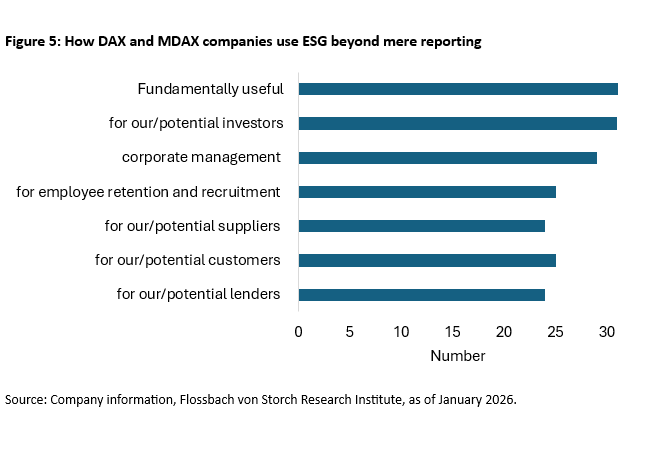

For all respondents (34 out of 35, with one abstention), ESG is not just a chore, but is used for purposes beyond reporting. The most frequently cited reason was the interest of current and potential investors in ESG (DAX: 19, MDAX: 12), followed by corporate governance (20/9). Lender and supplier interests (14/10, 19/5) as well as customer preferences and employee retention or recruitment (17/8, 19/6) follow at some distance (Figure 5).

Criticism of requirements

German companies are in limbo when it comes to ESG reporting because the federal government has left them in the lurch with the overdue legal implementation of the CSRD since summer 2024. This is also reflected in the responses that companies were able to provide on a voluntary basis as part of the survey. Companies are also critical of the new revised ESRS in many cases.

Among other things, it is noted that although the new ESRS bring relief, they also bring "new uncertainties." According to one DAX-listed company, "clarifications and refinements" are necessary. Another DAX-listed company criticises the lack of detail in the ESRS. Companies are unable to fully meet the requirements of rating agencies, for example. The fact that IFRS SDS must be observed in addition to the ESRS is also criticised. "Harmonisation or consistency in European standards" is necessary.

A reduction in reporting requirements does not mean "turning away from ESG in terms of content," but rather would free up resources "to deal with important matters," according to another DAX-listed company. One MDAX company questions the point of "long prose texts and irrelevant data points." This merely leads to bloated reporting and internal compliance costs.

Some DAX and MDAX companies point out that, in particular, companies reporting on ESG for 2024 and 2025 would initially have to put in a "considerable amount of revision work" with the new ESRS. "Despite the elimination of explicit reporting requirements," a lot of data would still have to be "collected." Changed presentation requirements would even lead to "additional effort" or additional "interpretation and documentation effort". One DAX-listed company notes that the question of the financial relevance of the effects of climate change is sufficiently discussed in theory, but that anticipating this in practice is "virtually impossible". Due to the many factors and uncertainties associated with the long time horizons, climate data would be as difficult to predict as future company share prices. One DAX company noted that reducing reporting requirements would bring "more clarity".

Conclusion

The topic of ESG is established among DAX and MDAX companies far beyond the mere reporting requirements. Although companies welcome the revised and reduced requirements on the part of the EU, they are dissatisfied with both the outcome and the implementation process, which is now being unnecessarily delayed by the second federal government in a row.

The schematic approach of the ESRS and the simultaneously applicable IFRS SDS standards continue to place a high compliance burden on companies. However, ESG reports do not necessarily provide investors and other stakeholders with complete and useful information for decision-making. Less regulation could therefore be more.

References

Draft Simplified ESRS (Technical Advice 30 November 2025), last accessed 10 January 2026 https://knowledgehub.efrag.org/

Juppe, T. A., Orth, C., Mayer, F., Marten, K.-U. (2026) "CSRD reporting in a country comparison: Effects of different degrees of implementation on sustainability reporting", KoR 01/2026

Press release "Simpler sustainability reporting and due diligence for companies" 16 December 2025, last accessed 6 January 2026 www.europarl.europa.eu

Schürmann, C. (2023) "In the ESG jungle", Flossbach von Storch Research Institute

Schürmann, C. (2023) "Marlboro Man beats Elon Musk", Flossbach von Storch Research Institute

Schürmann, C. (2024) "ESG rating regulation: Done deal in Brussels", Flossbach von Storch Research Institute

Schürmann, C. (2024) "Sustainability on the back burner", Flossbach von Storch Research Institute

Schürmann, C. (2025) "ESG reporting: a mixed bag", Flossbach von Storch Research Institute

__________________________________________________

1 The European Parliament has waved through a watered-down EU supply chain law. In future, companies with more than 5,000 employees and an annual turnover of at least €1.5 billion will be covered by the law, compared to the previous thresholds of 1,000 employees and €450 million in turnover. 85 per cent of the companies originally covered are now to be excluded from the scope of the supply chain law. The EU estimates that only 1,500 corporations operating across the EU will be affected in future.

2 www.bmjv.de/SharedDocs/Gesetzgebungsverfahren/DE/2025_CSRD-UmsG.html

3 dserver.bundestag.de/brd/2025/0552-25.pdf

4 In a first revision step, the mandatory data points were reduced from 803 to 347 (Exposure Draft ESRS July 2025, reduction of around 57%). By November 2025, further reductions and consolidation had been made, leaving around 320 mandatory data points.

Legal notice

The information contained and opinions expressed in this document reflect the views of the author at the time of publication and are subject to change without prior notice. Forward-looking statements reflect the judgement and future expectations of the author. The opinions and expectations found in this document may differ from estimations found in other documents of Flossbach von Storch SE. The above information is provided for informational purposes only and without any obligation, whether contractual or otherwise. This document does not constitute an offer to sell, purchase or subscribe to securities or other assets. The information and estimates contained herein do not constitute investment advice or any other form of recommendation. All information has been compiled with care. However, no guarantee is given as to the accuracy and completeness of information and no liability is accepted. Past performance is not a reliable indicator of future performance. All authorial rights and other rights, titles and claims (including copyrights, brands, patents, intellectual property rights and other rights) to, for and from all the information in this publication are subject, without restriction, to the applicable provisions and property rights of the registered owners. You do not acquire any rights to the contents. Copyright for contents created and published by Flossbach von Storch SE remains solely with Flossbach von Storch SE. Such content may not be reproduced or used in full or in part without the written approval of Flossbach von Storch SE.

Reprinting or making the content publicly available – in particular by including it in third-party websites – together with reproduction on data storage devices of any kind requires the prior written consent of Flossbach von Storch SE.

© 2026 Flossbach von Storch. All rights reserved.