COMMENT: The Swiss National Bank's room for manoeuvre is dwindling, partly because Switzerland is the last safe haven. The ECB's interest rate cuts are forcing negative interest rates and foreign currency purchases. However, the government bonds of the euro countries and the USA are increasingly risky.

1. Donald Trump shakes up Switzerland

Donald Trump has shaken up Switzerland. On the “Liberation Day”, Switzerland featured prominently on the list of "hostile countries" with trade surpluses with the US and was hit with a punitive tariff of 31 per cent.

Donald Trump's erratic tariff policy and the latest Big Beautifull Bill have put the Swiss franc under strong appreciation pressure against the dollar. The Swiss National Bank (SNB) could intervene against the appreciation, but then it would come under suspicion of "exchange rate manipulation" by the US President.

Following Trump’s conflict with Elon Musk, the likelihood of a debt crisis in the US has increased, meaning that the SNB now has to worry about its large dollar holdings. And there are more risks coming from the euro area.

2. The interest rate cut does not solve the problems

In this environment, the SNB cut the key interest rate to zero on 19 June. At first glance, the decision seems straightforward, because the price level is stable - the inflation rate was -0.1 per cent in May - and growth has cooled down.

The interest rate cut may help to revitalise investment and combat the appreciation of the Swiss franc to support the export industry, which is threatened by US tariffs and weak growth in the EU.

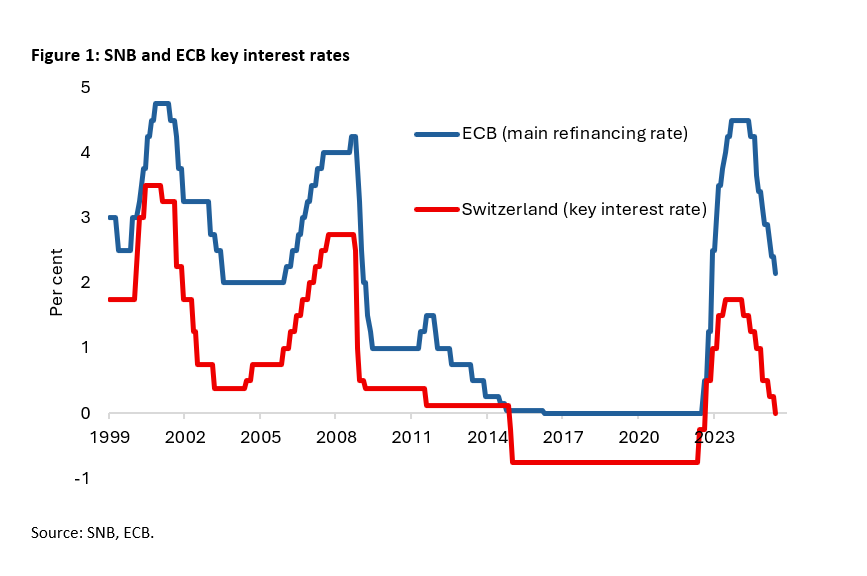

However, lowering the key interest rate to zero has brought Switzerland back to the brink of negative interest rates, which were already in place from 2015 to 2022 (Fig. 1). This is risky for at least three reasons.

3. Negative interest rates are risky

Firstly, positive lending rates ensure that investments are made in projects with good returns. If interest rates fall into negative territory, risky investments that are not sustainable in the long term become more likely. Weak growth and crises can be the result.

Secondly, negative interest rates are a burden on banks because the difference between lending and deposit interest rates - from which banks finance themselves - shrinks. Pension funds, which hold their reserves in risk-free, fixed-interest investments, will have to reduce their benefits.

Thirdly, cheap money favours exuberance on asset markets. During the last phase of negative interest rates, property prices in Switzerland rose sharply, which put a strain on young people in particular.

4. The curse of high net foreign assets

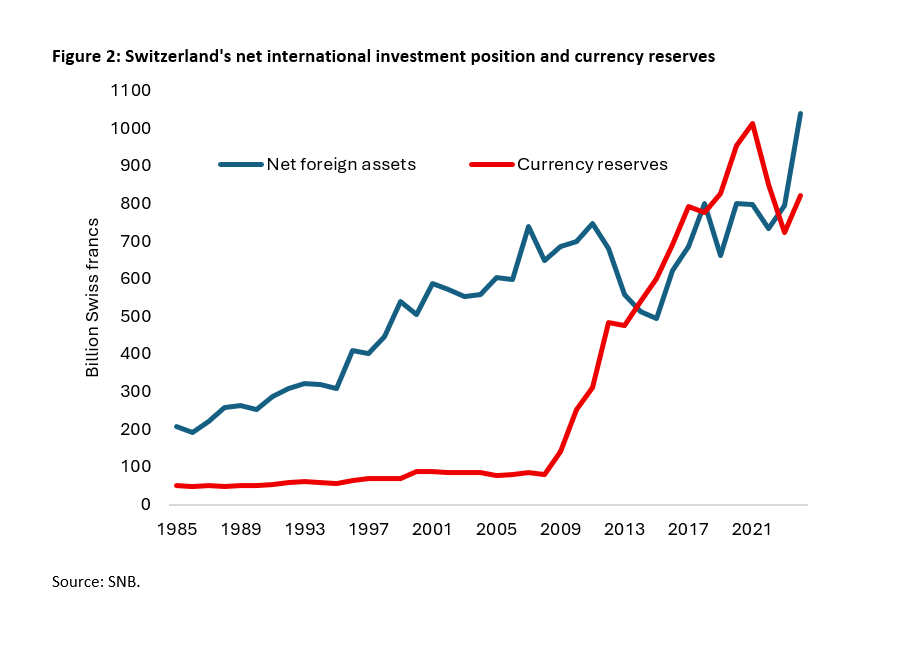

Switzerland is now threatening to become the first industrialised country to drift back into negative interest rates because it has had high current account surpluses and thus net capital exports since the early 1980s. The net international investment position of Switzerland stood at CHF 1,040 billion at the end of 2024 (Fig. 2), with foreign assets tending to be denominated in foreign currency.

This creates a risk because every appreciation of the franc generates valuation losses in terms of domestic currency. When the SNB announced in January 2015 that it would allow the franc to float freely, sudden appreciation expectations triggered a run into the franc, causing it to appreciate in a shock-like manner. As a result, the SNB had to buy foreign currency on a large scale in order to limit the damage to the export industry and financial markets.

A permanently lower interest rate level in Switzerland compared to the USA and the euro area indicates persistent appreciation expectations according to the open interest rate parity. This could explain why the SNB now holds a large part of Switzerlands net foreign assets in the form of currency reserves - the equivalent of CHF 823 billion at the end of 2024 (Fig. 2).

5. Increasingly limited room for manoeuvre for the SNB

The SNB's room for manoeuvre is limited, particularly because Switzerland, with its low level of debt, is seen more than ever as a safe haven in an increasingly unstable world. Whenever the European Central Bank (ECB) lowers interest rates, the SNB has to follow suit to prevent appreciation expectations (Fig. 1).

However, in the light of the harmful side effects of negative interest rates, the remaining room for manoeuvre for interest rate cuts is small, while the inherent instability of the euro area and Germany's announced tremendous increase in government debt mean that further interest rate cuts by the ECB are to be expected.

Although the SNB can curb an appreciation of the Swiss franc against the euro at any time by buying euros, it will then assume the default risks of the euro area countries' government bonds. As Donald Trump continues to make US Treasuries unattractive as an alternative, the SNB's last resort may be gold - or even Bitcoin. At least until the debt addiction in the major reserve currency countries finally comes to an end.

Legal notice

The information contained and opinions expressed in this document reflect the views of the author at the time of publication and are subject to change without prior notice. Forward-looking statements reflect the judgement and future expectations of the author. The opinions and expectations found in this document may differ from estimations found in other documents of Flossbach von Storch SE. The above information is provided for informational purposes only and without any obligation, whether contractual or otherwise. This document does not constitute an offer to sell, purchase or subscribe to securities or other assets. The information and estimates contained herein do not constitute investment advice or any other form of recommendation. All information has been compiled with care. However, no guarantee is given as to the accuracy and completeness of information and no liability is accepted. Past performance is not a reliable indicator of future performance. All authorial rights and other rights, titles and claims (including copyrights, brands, patents, intellectual property rights and other rights) to, for and from all the information in this publication are subject, without restriction, to the applicable provisions and property rights of the registered owners. You do not acquire any rights to the contents. Copyright for contents created and published by Flossbach von Storch SE remains solely with Flossbach von Storch SE. Such content may not be reproduced or used in full or in part without the written approval of Flossbach von Storch SE.

Reprinting or making the content publicly available – in particular by including it in third-party websites – together with reproduction on data storage devices of any kind requires the prior written consent of Flossbach von Storch SE.

© 2024 Flossbach von Storch. All rights reserved.