COMMENT. Many people dream of owning their own home but rising prices and high interest rates are making this difficult to achieve. We show how the affordability of real estate has developed.

Anyone currently looking to buy their own home faces major challenges. Residential property prices are rising and interest rates have plateaued at a high level. This raises the question of how affordable property is at present and whether it was easier to get on the property ladder in the past.

Many property developers, sellers and financial brokers advertise attractive financing options and often appealing monthly instalments on the relevant property portals. But does the monthly payment provide sufficient information about whether a property is affordable for a household?

The monthly instalment on a mortgage loan consists of the interest payable and the principal repayment. While the interest rate is determined by the issuer's credit rating and the equity ratio, there is some leeway when it comes to the amount of the principal repayment. Since a household usually has no way of increasing its income in the short term, it can be assumed that there is an upper limit for the repayment instalment. This instalment maximises the monthly burden, so that a loan agreement with a bank would still be signed.1

If we combine the highest possible repayment rate with the purchase price of the property and the available equity, we can draw up a repayment plan for a mortgage. Since the monthly payment and the loan amount are fixed, the calculation results in the remaining debt at the end of the fixed-interest period.

If the remaining debt is very high at the end of the fixed-interest period, when income and interest payments leave little room for repayment, the high remaining debt poses a significant risk for the bank and the household, especially if interest rates have risen at that point. This can result in either the bank refusing to grant the loan or the household having to decide against purchasing the property. The remaining debt therefore provides information about whether a household can afford a property or not. This information is not usually included in the advertised monthly payment, which can be reduced by keeping the repayment instalments as low as possible.

Mathematically, assuming a constant interest rate and repayment rate, the remaining debt can be converted into the number of years until full repayment. This repayment period can therefore be used as a measure of the affordability of a property.

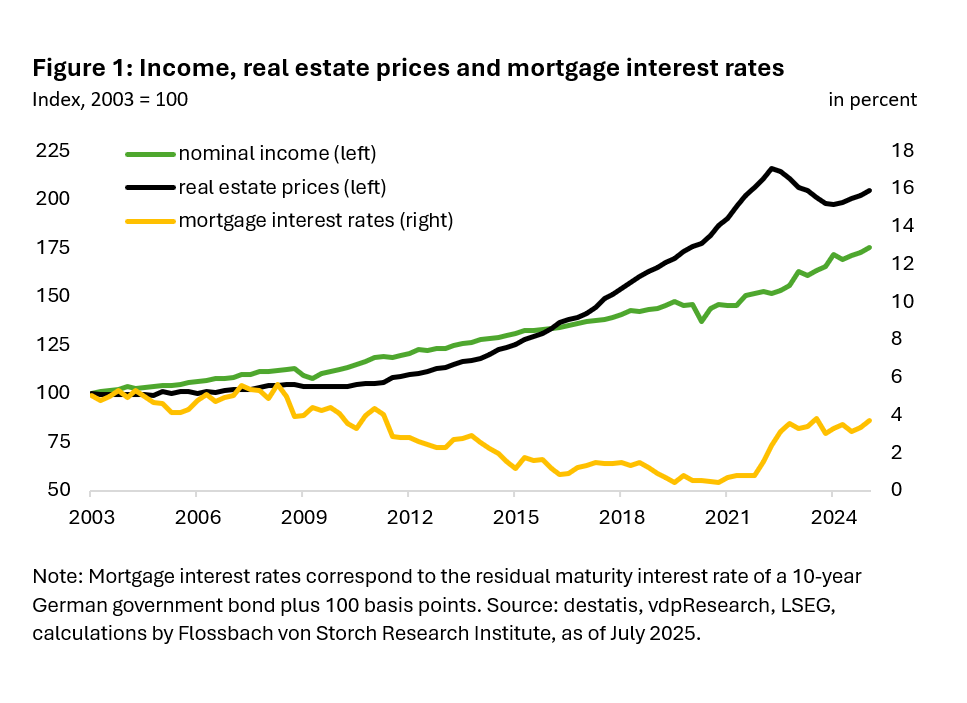

In order to assess how the affordability of real estate has developed over the past 20 years, we first look at the development of residential property prices (vdpResearch), nominal incomes (destatis) and mortgage interest rates.2 Figure 1 shows the rise in real estate prices, which outpaced the development of nominal incomes in the 2010s. At the same time, interest rates fell between 2008 and 2022.

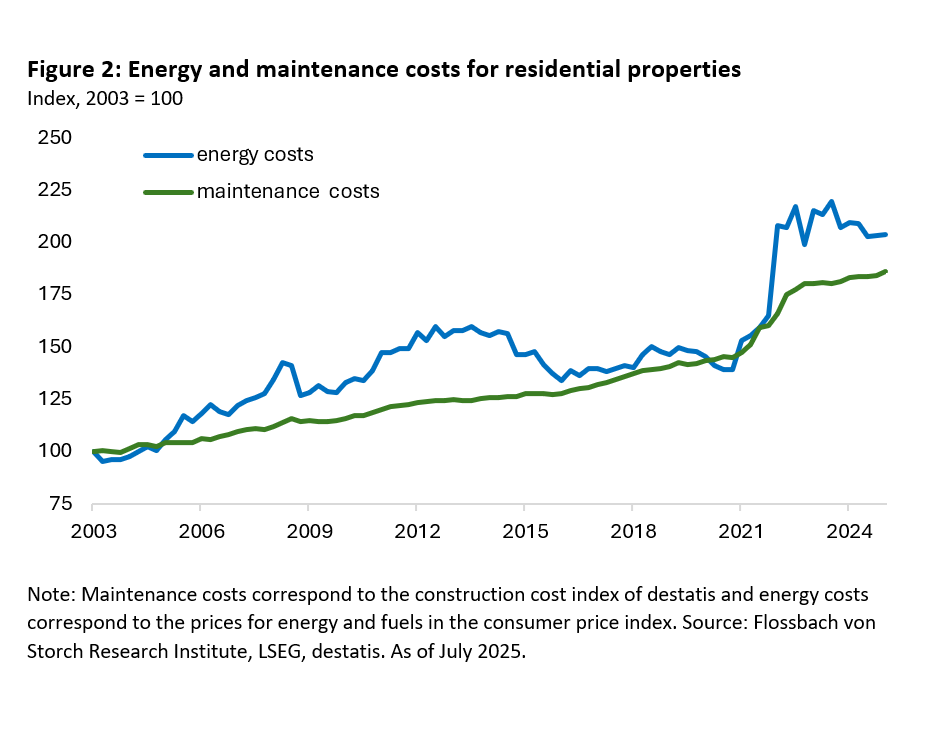

In addition, the development of maintenance and energy costs is included in the calculation, as these also place a burden on a household's monthly budget. Figure 2 shows how these costs have developed. In particular, the drastic increase in costs in the wake of the coronavirus crisis and with the start of the war in Ukraine is clearly visible.

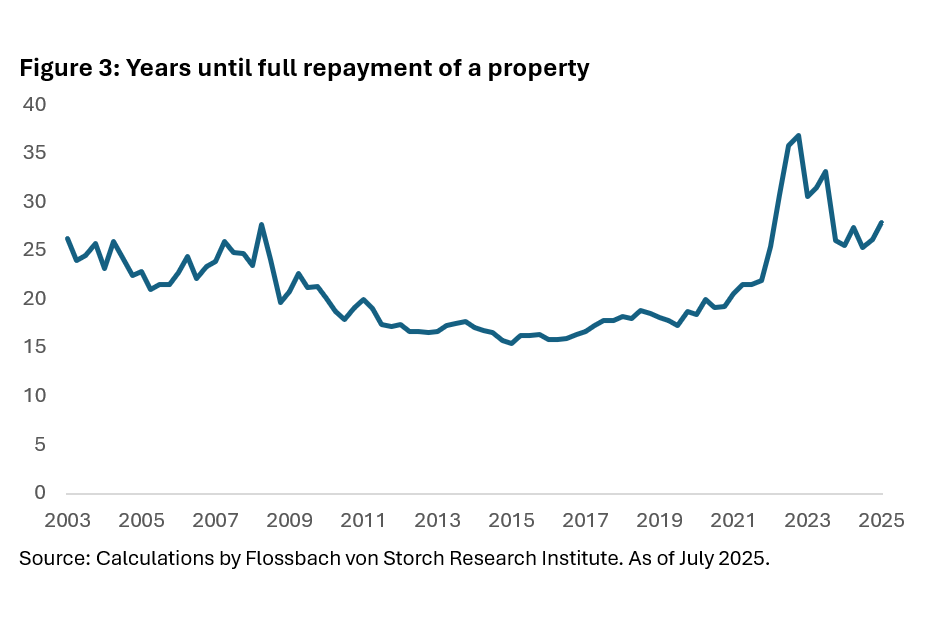

Figure 3 shows the resulting expected repayment period in years. It is subject to constant fluctuation. In the 2010s, the repayment period declined slowly, reaching a low point of 15 years in 2015. This marks the point in time when real estate was most affordable since 2003.

Although real estate prices rose in the following years, falling interest rates and income growth largely offset the rising prices. It was not until interest rates rose in 2022, accompanied by rising energy and renovation costs, that buying a property became significantly more difficult. The expected repayment period skyrocketed, reaching 37 years in 2022. In the period that followed, both interest rates and real estate prices fell, reducing the repayment period to 25 years. However, the recent rise in real estate prices has caused the repayment period to rise again to just under 28 years.

Anyone looking to buy a property today has to repay their mortgage for much longer, in some cases almost twice as long as 10 years ago. As a result, many households are finding that they cannot afford to buy a property like their friends and acquaintances who found something in the 2010s.

It is uncertain whether interest rates on mortgages will fall in the future and how rising real estate prices will be able to compensate for this in the 2010s. While the ECB is expected to lower its key interest rate further in autumn 2025, mortgage rates depend on the yield on long-term German government bonds. The federal government's planned new borrowing could cause market interest rates to rise, making real estate financing even more expensive. The renewed rise in residential property prices also indicates that affordability is currently deteriorating again.

Unfortunately, this is not good news for young families and other prospective buyers, who will have to come to terms with reality, for better or worse.

______________________________________________________________

1 This limit is often stated as 30% to 40% of net income. See Commerzbank or Dr. Klein.

2 Mortgage interest rates are estimated as the yield to maturity of a 10-year German government bond plus a premium of 100 basis points.

3 The calculation was based on the following key data for 2023 and extrapolated back to 2023 or projected forward to 2025 using the corresponding time series. The average purchase price for residential property (owner-occupied flats or houses) in Germany was most recently around €350,000. Of this, an average of 86 per cent was financed by a loan. The monthly budget available to a buyer household for loan repayments was €1,600 (Europace). In addition, there are monthly energy costs of €200 (equivalent to €2.00 per square metre for a 100 m² apartment) and maintenance costs of €100 (equivalent to €1.00 per square metre for a 100 square metre apartment, Source: Association of Private Builders), bringing the total monthly budget for a property buyer to £1,900. The calculation method presented here differs from the methodology used in the Interhyp-IW affordability index. In our approach, the repayment period is the free variable, while the affordability index is based on a comparison of monthly costs and real estate prices, assuming other conditions remain unchanged.

Legal notice

The information contained and opinions expressed in this document reflect the views of the author at the time of publication and are subject to change without prior notice. Forward-looking statements reflect the judgement and future expectations of the author. The opinions and expectations found in this document may differ from estimations found in other documents of Flossbach von Storch SE. The above information is provided for informational purposes only and without any obligation, whether contractual or otherwise. This document does not constitute an offer to sell, purchase or subscribe to securities or other assets. The information and estimates contained herein do not constitute investment advice or any other form of recommendation. All information has been compiled with care. However, no guarantee is given as to the accuracy and completeness of information and no liability is accepted. Past performance is not a reliable indicator of future performance. All authorial rights and other rights, titles and claims (including copyrights, brands, patents, intellectual property rights and other rights) to, for and from all the information in this publication are subject, without restriction, to the applicable provisions and property rights of the registered owners. You do not acquire any rights to the contents. Copyright for contents created and published by Flossbach von Storch SE remains solely with Flossbach von Storch SE. Such content may not be reproduced or used in full or in part without the written approval of Flossbach von Storch SE.

Reprinting or making the content publicly available – in particular by including it in third-party websites – together with reproduction on data storage devices of any kind requires the prior written consent of Flossbach von Storch SE.

© 2026 Flossbach von Storch. All rights reserved.