Donald Trump has shaken the world's financial markets with his tariff frenzy. He wants to use tariffs to bring industrial jobs back to the USA and thus counteract the massive increase in inequality. This is dangerous, as the risk of a gigantic financial crisis is high due to inflated financial markets. Only deregulation and spending cuts can counteract the division in US society.

1. Tariffs Against Inequality

Donald Trump has caused the financial markets to tremble. Following his announcement of so-called reciprocal tariffs, share prices plummeted worldwide. Not only major export nations such as Germany and Japan, but also the import world champion USA was hit. What was Donald Trump up to?

One obvious reason: many of his voters have suffered from globalization. Not only have many industrial jobs been lost since the turn of the millennium. The purchasing power of industrial workers has also come under pressure. The tariffs are intended to bring industrial jobs back to the USA, says Trump.

However, financial, health and education sectors have benefited from the crisis in industry, which has led to a sharp rise in inequality. Is it possible to counteract the division of society with tariffs? Possibly only at the cost of a major financial crisis?

2. The Fed and China Are Driving Deindustrialization in the USA

At the heart of the massive increase in inequality in the US is the Fed, the central bank, which has continued to cut interest rates for a long time since the turn of the millennium and launched major purchase programs for US government bonds. In financial crises, it has acted as a fire department, using cheap money to create ever new price fireworks on the financial markets.

In addition, the low interest rates in the US meant that a lot of capital flowed into China for many years. As China had pegged its currency to the dollar, the People's Bank of China had to buy large quantities of dollars. It invested a considerable amount of these in US government bonds.

China's government channeled the large amount of capital via the state-controlled banks into the build-up of huge industrial overcapacity, for whose output the Chinese market was too small despite its large population. China therefore had to sell considerable parts of its overproduction in the industrialized countries - subsidized by cheap loans. This has particularly put US industry under pressure.

3. The International Distribution Effects of Overglobalization

The US financial sector was not only jubilant because the Fed kept pushing up asset prices with low interest rates and bond-buying programs. The financial sector also made money from China's huge foreign exchange transactions and financial investments in the US.

The Chinese industry flourished, resulting in a strong expansion in employment. Thanks to huge productivity gains, not only the wages of China's industrial workers rose rapidly. The immense gains in prosperity also increased the demand for living space, which led to a housing bubble that continued to fuel growth until it burst.

Workers in US industry, on the other hand, suffered from Chinese competition, which put pressure on prices and wages in US industry thanks to cheap capital (from the US) and cheap labor (from China). Both the US governments - which were close to the financial sector? -, as well as the Chinese Communist Party, which has remained committed to the industrial sector, allowed the process to run its course. And this despite the fact that excessively low interest rates pushed globalization beyond a healthy level, which can be understood as "over-globalization"!

4. The distribution effects in the USA

From a theoretical perspective, international trade benefits all parts of society if - as has been the case in the USA since the turn of the millennium - it does not result in unemployment. Specialization increases productivity, which makes wage increases possible across all sectors. Anyone who becomes unemployed in industry can move to the service sector, where wage levels rise thanks to productivity gains.

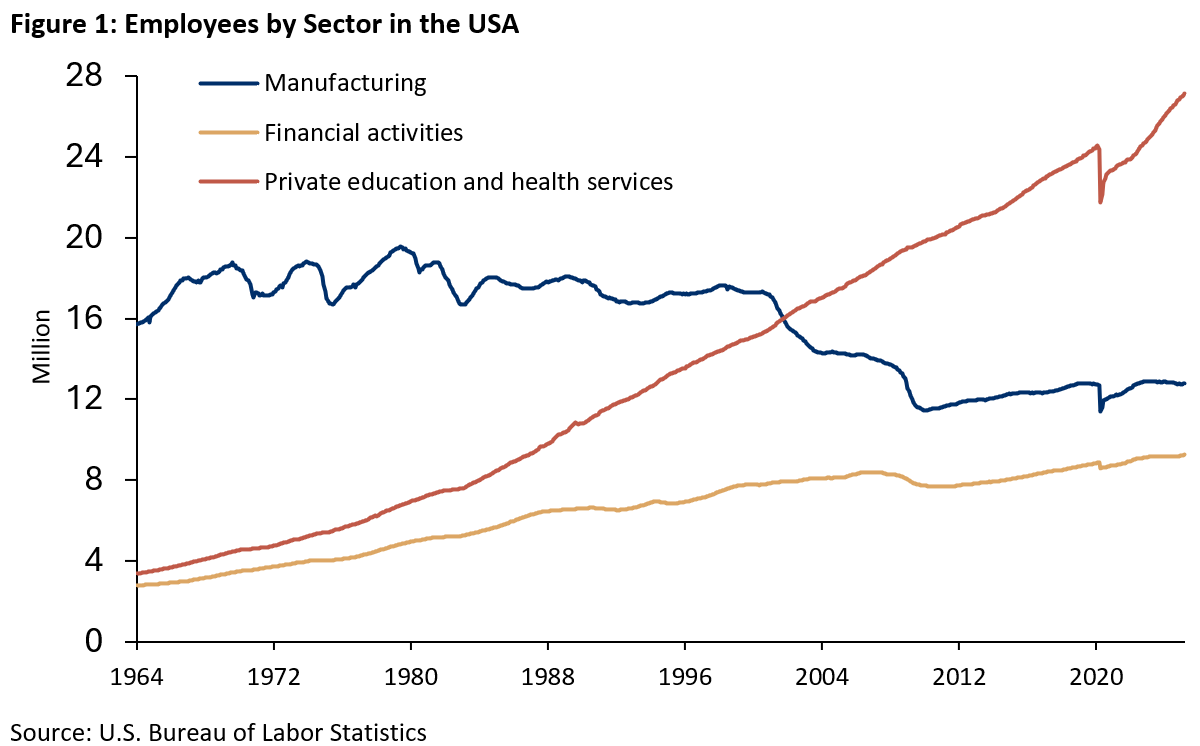

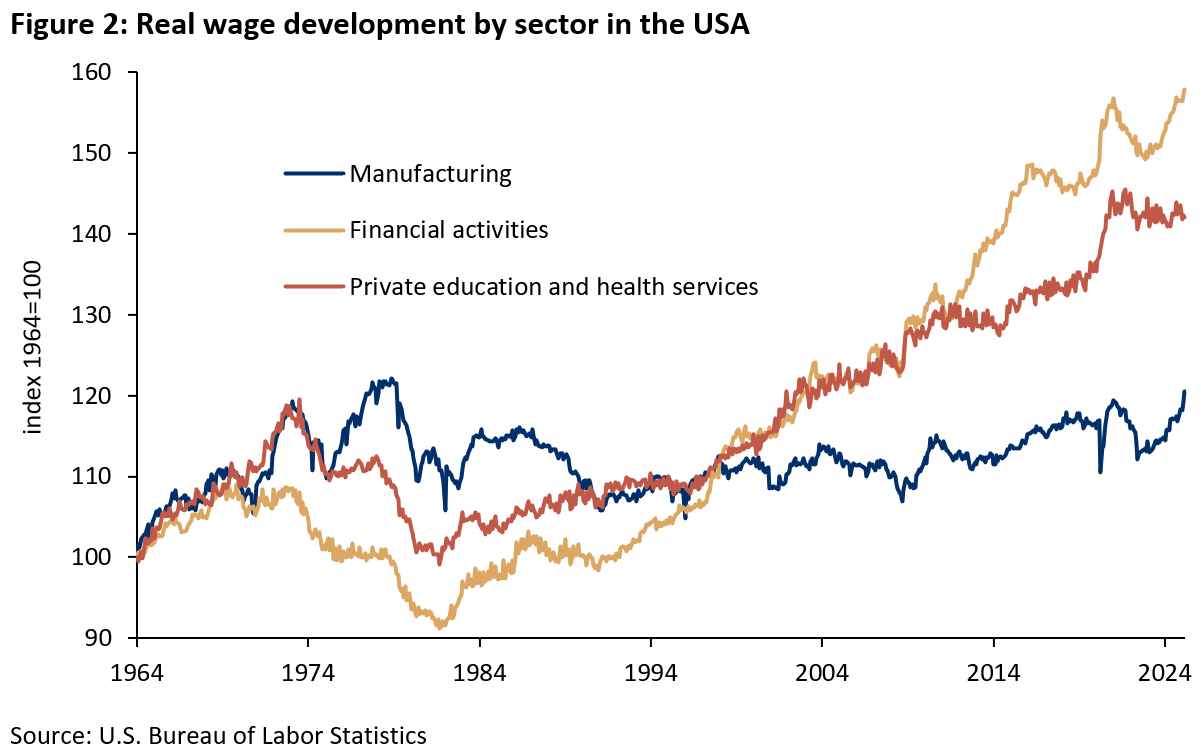

But not so in the USA since the turn of the millennium. While jobs have been lost in industry and real wages have stagnated, the number of jobs and real wages have risen significantly in the financial sector - thanks in particular to the Fed's loose monetary policy. As the Fed's low interest rates have driven up asset prices, the rich have become even richer.

In addition, thanks to lavish government bond purchases by the Fed and the People's Bank of China, the US state has been able to redistribute heavily in favor of the healthcare and education sectors, resulting in a sharp rise in employment and real wages. This has divided society.

5. How can Donald Trump succeed?

Donald Trump has struck a chord with the losers with "Make America Great Again". In his first election campaign in 2016, he successfully stigmatized Hillary Clinton as a puppet of Wall Street. The planned dismissal of many civil servants with a good work-life balance - including 20,000 employees in the US Department of Health and Human Services - and funding cuts for universities such as Harvard are likely to go down well with his voters.

On the other hand, he cannot bring industrial jobs back to the USA with destructive tariffs, as wage levels in East Asia are simply much lower. Instead, prices will rise. And with his heavy-handed approach, Trump risks causing the bloated financial markets to stumble. Super-rich supporters such as Elon Musk, Timothy Mellon and Peter Thiel are unlikely to appreciate this.

The dilemma can only be solved if Trump focuses his policy not on tariffs but on deregulation and spending cuts. If he significantly reduces the government deficit and the Fed tightens monetary policyin future, this would put an end to the great redistribution. As companies would be forced to increase efficiency, this would slowly bring their real value closer to the highly inflated share prices. The persistent danger of a bursting share price bubble would be averted.

Legal notice

The information contained and opinions expressed in this document reflect the views of the author at the time of publication and are subject to change without prior notice. Forward-looking statements reflect the judgement and future expectations of the author. The opinions and expectations found in this document may differ from estimations found in other documents of Flossbach von Storch SE. The above information is provided for informational purposes only and without any obligation, whether contractual or otherwise. This document does not constitute an offer to sell, purchase or subscribe to securities or other assets. The information and estimates contained herein do not constitute investment advice or any other form of recommendation. All information has been compiled with care. However, no guarantee is given as to the accuracy and completeness of information and no liability is accepted. Past performance is not a reliable indicator of future performance. All authorial rights and other rights, titles and claims (including copyrights, brands, patents, intellectual property rights and other rights) to, for and from all the information in this publication are subject, without restriction, to the applicable provisions and property rights of the registered owners. You do not acquire any rights to the contents. Copyright for contents created and published by Flossbach von Storch SE remains solely with Flossbach von Storch SE. Such content may not be reproduced or used in full or in part without the written approval of Flossbach von Storch SE.

Reprinting or making the content publicly available – in particular by including it in third-party websites – together with reproduction on data storage devices of any kind requires the prior written consent of Flossbach von Storch SE.

© 2024 Flossbach von Storch. All rights reserved.