08.04.2019 - Comments

![[Translate to English:]](https://www.flossbachvonstorch-researchinstitute.com//fileadmin/_processed_/5/b/csm_kommentar-philipp-immenkoetter-klein_33283eeca4.jpg)

Ten DAX and MDAX companies have already repurchased their own shares this year and four more consider doing so. Whether this is good or bad for shareholders depends, among other things, on their timing.

The price at which a company acquires its own shares is decisive. Buybacks are usually carried out when cash holdings are high and business is going well. However, this is usually accompanied by high share prices, which make buybacks expensive. If, on the other hand, share prices are low, companies usually lack the funds to buy their own shares. Thus, in times of high liquidity, companies face the dilemma of either buying their own shares at high prices or investing the free funds in unprofitable alternatives.

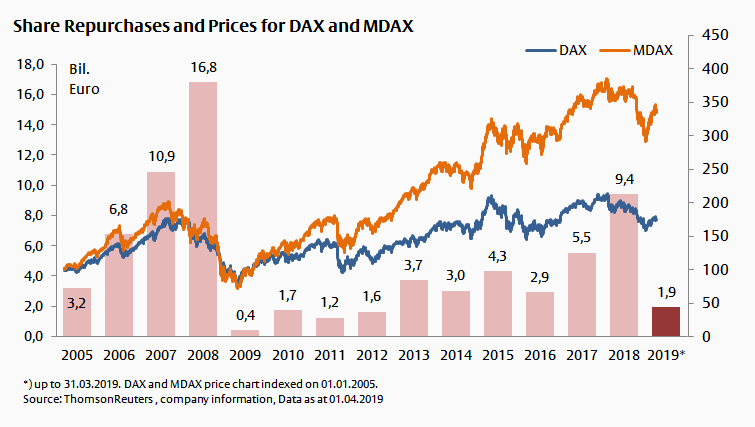

The graph illustrates the situation. Times of high prices, such as 2007/2008, 2015 and 2017/2018, coincide with high buyback volumes. After price drops, on the other hand, buybacks volumes decline. This can be clearly seen in 2009 and 2016.

German companies seem to want to solve the dilemma through procyclical share buybacks. Only Munich Re has managed to extend share buybacks over a longer period and has bought its own shares in 11 of the last 14 years.

The ten currently active repurchasers include familiar names such as Adidas and Linde, who already carried out repurchases last year. On the other hand, new players such as Fresenius Medical Care, Lanxess and Osram Licht are also among them. If the announced volumes were realized in 2019, the level at the end of the year would be similar to that at the end of 2018.

Despite the recent profit warnings and forecast adjustments, share prices seem to have recovered, so that it is to be expected that the outstanding buybacks will again be carried out at record prices. Thereby it would be possible to escape the dilemma: For example, with a special dividend. Although it is not as flexible as buying back shares, it circumvents the problem that capital distribution depends on the share price and funds vanish if prices fall subsequently.

Legal notice

The information contained and opinions expressed in this document reflect the views of the author at the time of publication and are subject to change without prior notice. Forward-looking statements reflect the judgement and future expectations of the author. The opinions and expectations found in this document may differ from estimations found in other documents of Flossbach von Storch SE. The above information is provided for informational purposes only and without any obligation, whether contractual or otherwise. This document does not constitute an offer to sell, purchase or subscribe to securities or other assets. The information and estimates contained herein do not constitute investment advice or any other form of recommendation. All information has been compiled with care. However, no guarantee is given as to the accuracy and completeness of information and no liability is accepted. Past performance is not a reliable indicator of future performance. All authorial rights and other rights, titles and claims (including copyrights, brands, patents, intellectual property rights and other rights) to, for and from all the information in this publication are subject, without restriction, to the applicable provisions and property rights of the registered owners. You do not acquire any rights to the contents. Copyright for contents created and published by Flossbach von Storch SE remains solely with Flossbach von Storch SE. Such content may not be reproduced or used in full or in part without the written approval of Flossbach von Storch SE.

Reprinting or making the content publicly available – in particular by including it in third-party websites – together with reproduction on data storage devices of any kind requires the prior written consent of Flossbach von Storch SE.

© 2024 Flossbach von Storch. All rights reserved.