24.07.2019 - Studies

The upcoming monetary policy decisions of both the ECB and the Fed therefore have the potential to surprise the market.

With growing trade and geopolitical tensions and falling inflation expectations, market participants have raised expectations of a return to monetary easing on both sides of the Atlantic. However, there is no consensus on the extent of the stimulus. The upcoming monetary policy decisions of both the ECB and the Fed therefore have the potential to surprise the market.

Loosing economic momentum across the pond

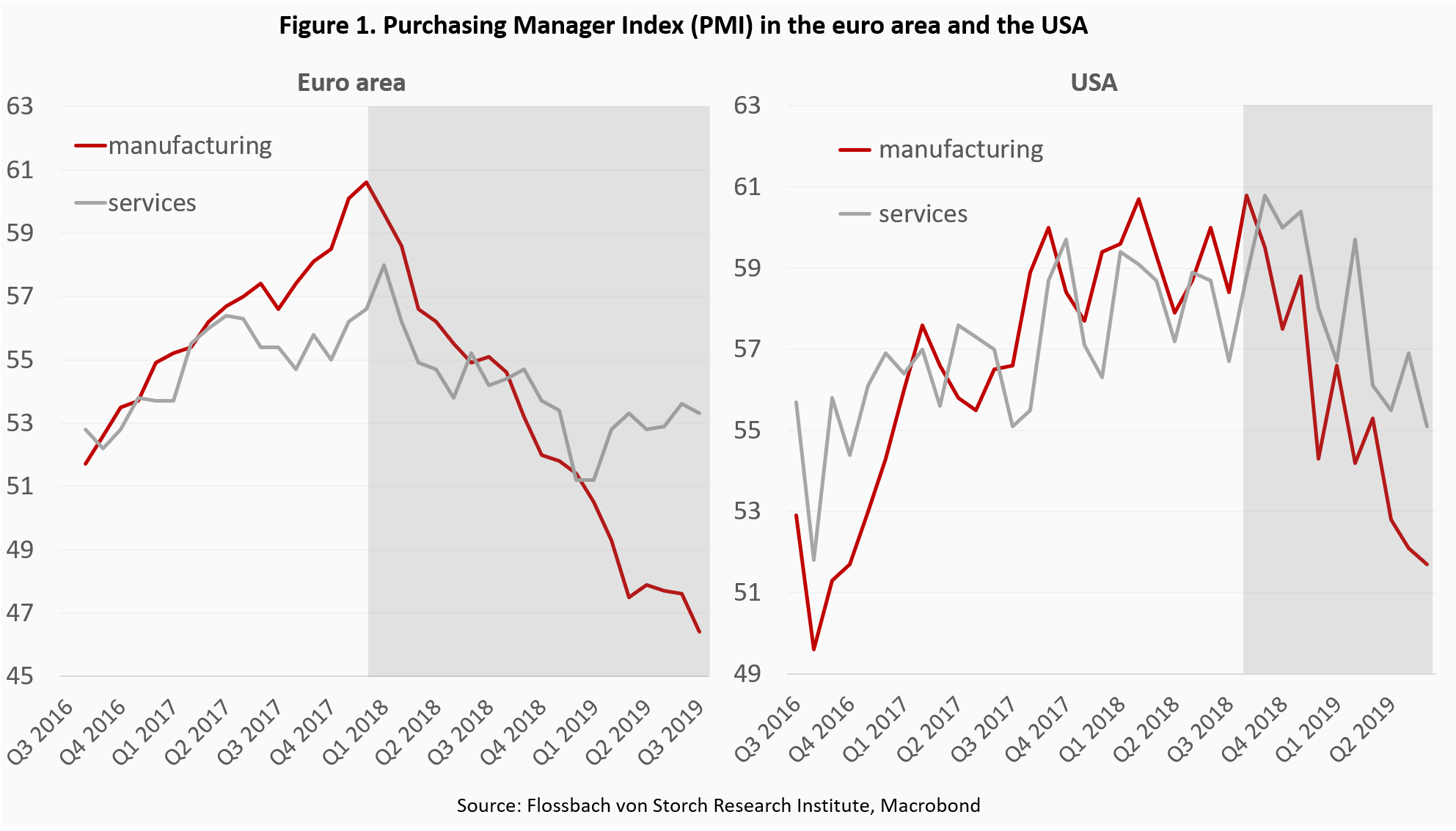

The economic growth in the euro area and the USA has been slowing down for several quarters. Especially the economic health of the manufacturing sector has been negatively affected, but also services have lost the growth momentum (Fig. 1). There is no single reason for this slowdown, but one of the most important factors is undoubtedly the continuing trade and geopolitical tensions.

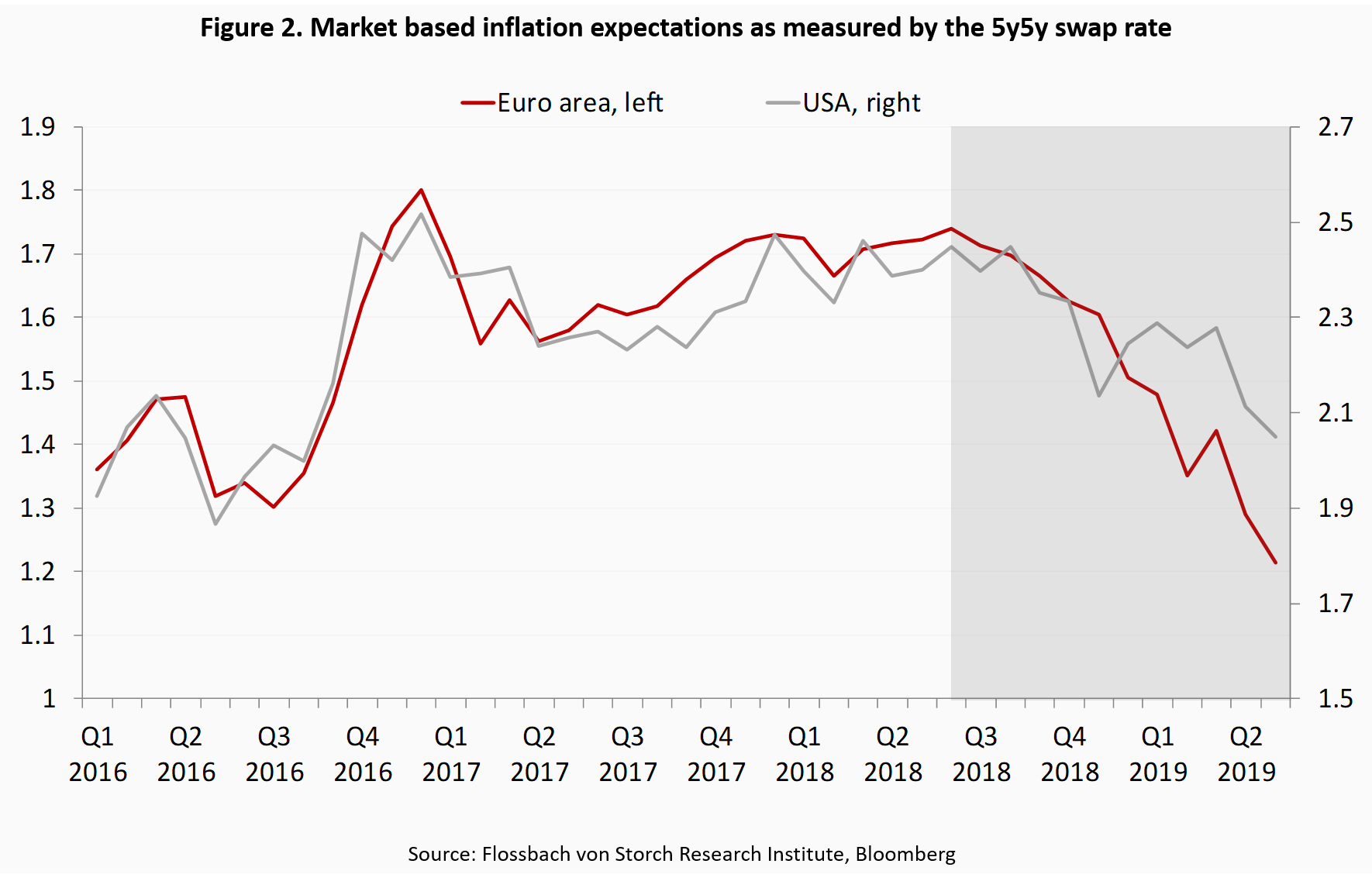

Inflation expectations in the USA and the euro area also weakened considerably after peaking in mid-2018 (Fig. 2). Since inflation expectations are an important performance indicator for the ECB and the Fed to assess the effectiveness of their monetary policy, market participants now broadly expect both central banks to shift their policy stances towards easing.

How much surprise could there be?

These growing expectations have been already supported by preliminary, albeit inaccurate, announcements by ECB President Mario Draghi during his speech in Sintra on June 18 and by Fed’s Chair Jerome Powell in his testimony before the US Senate Banking Committee on July 11.

However, although there is broad market consensus that both central banks will adjust their policies towards monetary accommodation at the forthcoming monetary policy meetings, there is still ample scope for surprises for the respective degrees of easing.

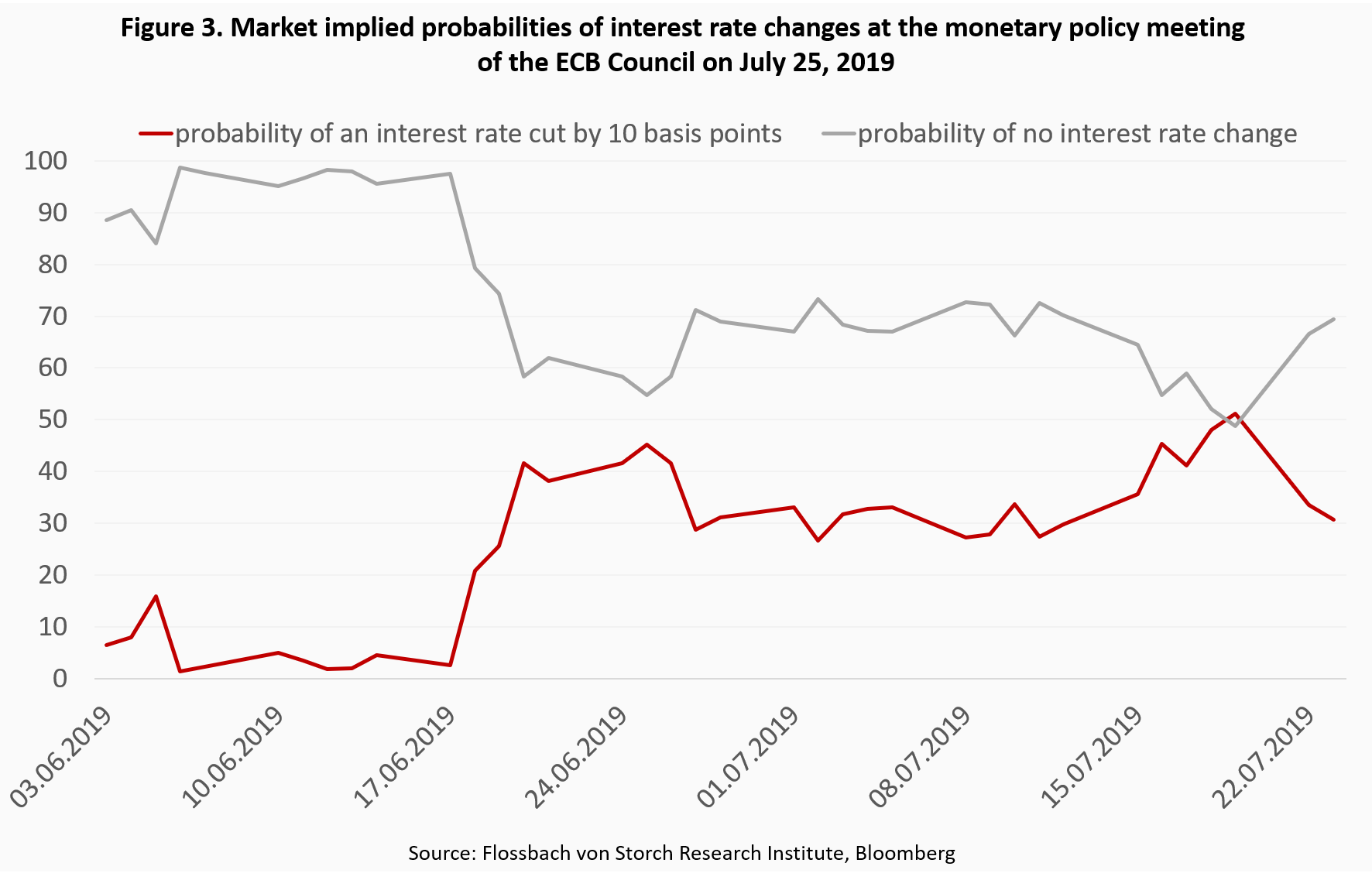

In the case of the ECB, market implied probability of no interest rate change has fallen from almost 100% before the Sintra speech to around 55% afterwards, giving room to the (residual) probability of an interest rate cut by 10 basis points (Fig. 3). This in turn means that the majority of market participants still do not expect the ECB to actually cut rates on July 25 – even if they do so for later meetings this year. However, an appropriate reading of economic data would be a sufficient reason for the ECB to act pre-emptively and surprise the market with an immediate rate cut. A surprising interest rate cut is certainly less painful than a surprising interest rate hike.

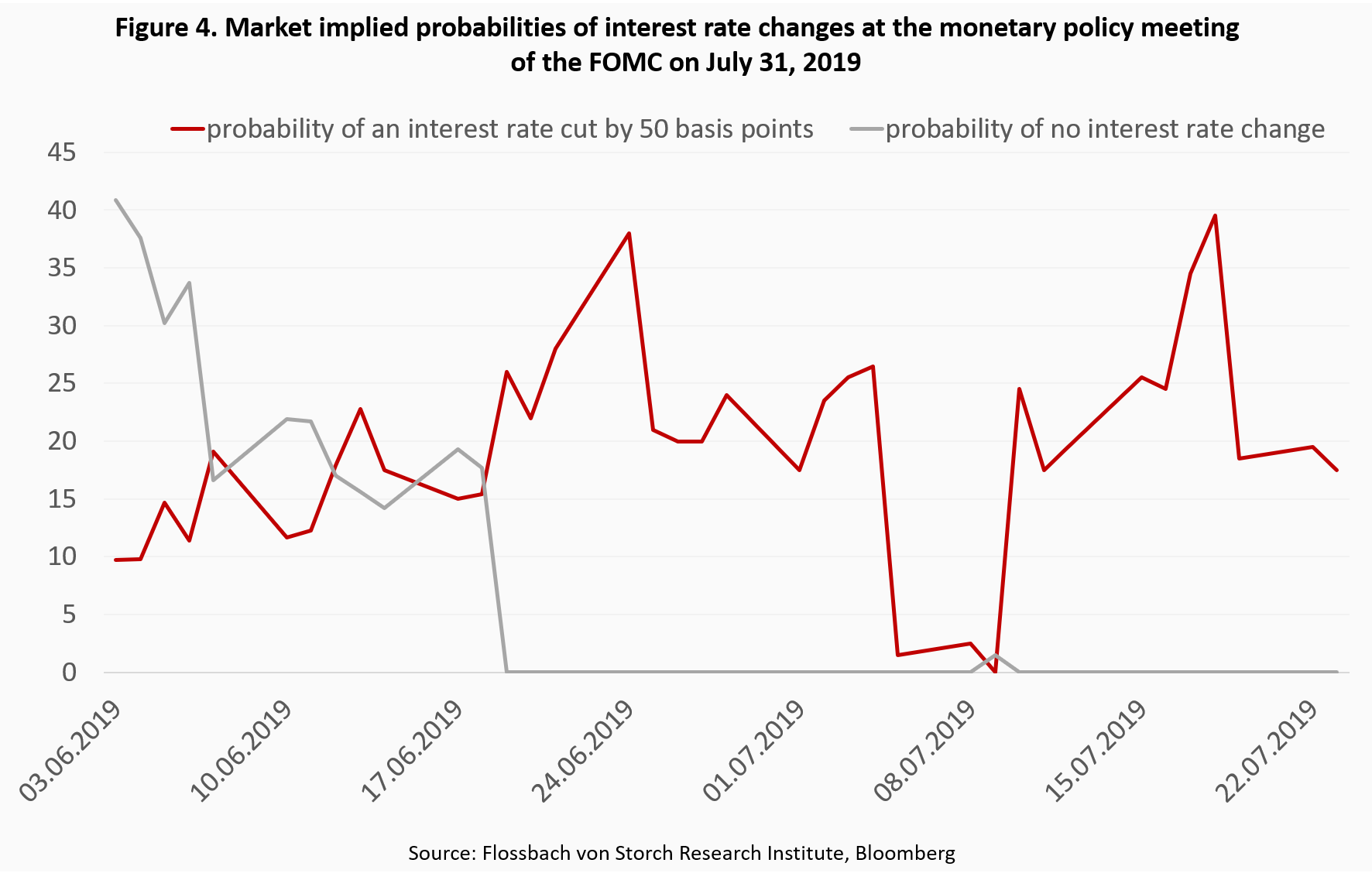

For the next FOMC meeting on July 31, the market implied probability of no interest rate change has reached the lower bound on June 18 and has stayed there since, implying that the Fed is highly expected to loosen its policy stance (Fig. 4). However, market participants are very much unsure about the extent of the easing. The market implied probability of an interest rate cut by 50 basis points at the July FOMC meeting was volatile, ranging from 0% on July 10 to almost 40% a week later. This also has the potential for a surprise.

Outlook

After a short attempt to normalize monetary policy, it is again turning into accommodation. But whatever the ECB and the Fed will do about their policy rates at the next July meetings, the scope for the interest rate as an effective policy tool is very limited. The central banks seem to have more or less already arrived at this insight. The Fed is currently reviewing its monetary policy framework and is supposed to announce its findings during the spring next year. The ECB cannot afford to be inactive and will most likely be forced to do so as well. It remains to be seen how creative the central banks will become.

Legal notice

The information contained and opinions expressed in this document reflect the views of the author at the time of publication and are subject to change without prior notice. Forward-looking statements reflect the judgement and future expectations of the author. The opinions and expectations found in this document may differ from estimations found in other documents of Flossbach von Storch AG. The above information is provided for informational purposes only and without any obligation, whether contractual or otherwise. This document does not constitute an offer to sell, purchase or subscribe to securities or other assets. The information and estimates contained herein do not constitute investment advice or any other form of recommendation. All information has been compiled with care. However, no guarantee is given as to the accuracy and completeness of information and no liability is accepted. Past performance is not a reliable indicator of future performance. All authorial rights and other rights, titles and claims (including copyrights, brands, patents, intellectual property rights and other rights) to, for and from all the information in this publication are subject, without restriction, to the applicable provisions and property rights of the registered owners. You do not acquire any rights to the contents. Copyright for contents created and published by Flossbach von Storch AG remains solely with Flossbach von Storch AG. Such content may not be reproduced or used in full or in part without the written approval of Flossbach von Storch AG.

Reprinting or making the content publicly available – in particular by including it in third-party websites – together with reproduction on data storage devices of any kind requires the prior written consent of Flossbach von Storch AG.

© 2024 Flossbach von Storch. All rights reserved.